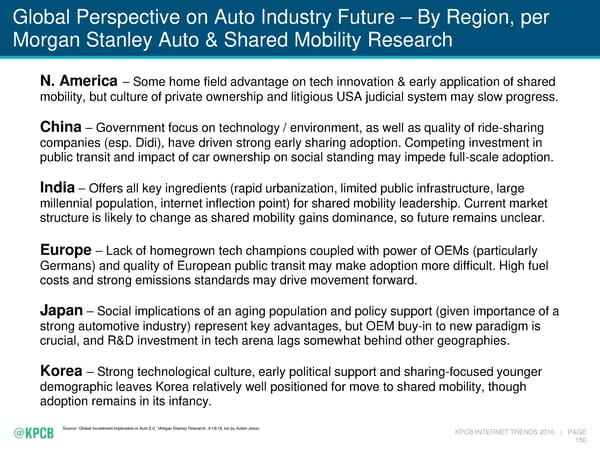

Global Perspective on Auto Industry Future – By Region, per Morgan Stanley Auto & Shared Mobility Research N. America – Some home field advantage on tech innovation & early application of shared mobility, but culture of private ownership and litigious USA judicial system may slow progress. China – Government focus on technology / environment, as well as quality of ride-sharing companies (esp. Didi), have driven strong early sharing adoption. Competing investment in public transit and impact of car ownership on social standing may impede full-scale adoption. India – Offers all key ingredients (rapid urbanization, limited public infrastructure, large millennial population, internet inflection point) for shared mobility leadership. Current market structure is likely to change as shared mobility gains dominance, so future remains unclear. Europe – Lack of homegrown tech champions coupled with power of OEMs (particularly Germans) and quality of European public transit may make adoption more difficult. High fuel costs and strong emissions standards may drive movement forward. Japan – Social implications of an aging population and policy support (given importance of a strong automotive industry) represent key advantages, but OEM buy-in to new paradigm is crucial, and R&D investment in tech arena lags somewhat behind other geographies. Korea – Strong technological culture, early political support and sharing-focused younger demographic leaves Korea relatively well positioned for move to shared mobility, though adoption remains in its infancy. Source: ‘Global Investment Implication of Auto 2.0,’ Morgan Stanley Research, 4/19/16, led by Adam Jonas KPCB INTERNET TRENDS 2016 | PAGE 150

Mary Meeker's Annual Internet Trends Report Page 150 Page 152

Mary Meeker's Annual Internet Trends Report Page 150 Page 152