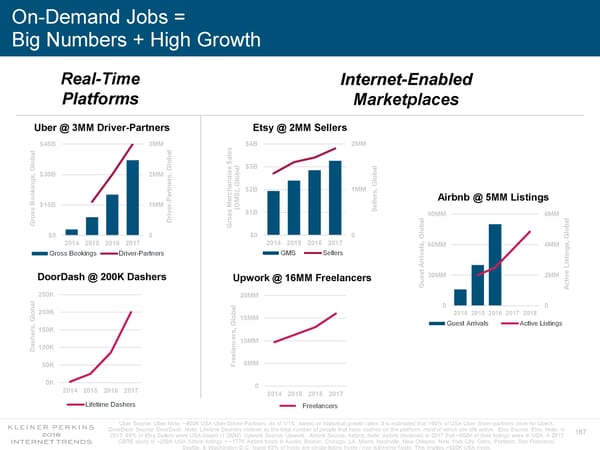

On-Demand Jobs = Big Numbers + High Growth Real-Time Internet-Enabled Platforms Marketplaces Uber @ 3MM Driver-Partners Etsy @ 2MM Sellers $45B 3MM $4B 2MM s e l a obal obal S e $3B Gl Gl s , $30B 2MM s obal obal ngs, Gl Gl ner handi, , )$2B 1MM rt a rcS rs ooki P e e Airbnb @ 5MM Listings l B - l $15B 1MM r M GM e e ( s S v s $1B 90MM 6MM ri l D Gros Gros obal oba l $0 0 $0 0 Gl G , , 2014 2015 2016 2017 2014 2015 2016 2017 s l60MM 4MM a ngs Gross Bookings Driver-Partners GMS Sellers v i t rri s A Li t s e 30MM 2MM v DoorDash @ 200K Dashers i Upwork @ 16MM Freelancers t c Gue A 250K 20MM 0 0 obal200K 2014 2015 2016 2017 2018 obal Gl 15MM , Gl Guest Arrivals Active Listings s , 150K rs her s 10MM a nce 100K a D l e Fre5MM 50K 0K 0 2014 2015 2016 2017 2014 2015 2016 2017 Lifetime Dashers Freelancers Uber Source: Uber Note: ~900K USA Uber Driver-Partners. As of 1/15, based on historical growth rates, it is estimated that >90% of USA Uber driver-partners drive for UberX. DoorDash Source: DoorDash. Note: Lifetime Dashers defined as the total number of people that have dashed on the platform, most of which are still active. Etsy Source: Etsy. Note: In 167 2017, 65% of Etsy Sellers were USA-based (1.2MM). Upwork Source: Upwork. Airbnb Source: Airbnb, Note: Airbnb disclosed in 2017 that ~660K of their listings were in USA. A 2017 CBRE study of ~256K USA Airbnb listings + ~177K Airbnb hosts in Austin, Boston, Chicago, LA, Miami, Nashville, New Orleans, New York City, Oahu, Portland, San Francisco, Seattle, & Washington D.C. found 83% of hosts are single-listing hosts / non-full-home hosts. This implies >500K USA hosts.

Internet Trends 2018 Page 166 Page 168

Internet Trends 2018 Page 166 Page 168