Internet Trends 2018

Mary Meeker | May 30 @ Code 2

INTERNET TRENDS 2018 Mary Meeker May 30 @ Code 2018 kleinerperkins.com/InternetTrends

Thanks Kleiner Perkins Partners Ansel Parikh & Michael Brogan helped steer ideas and did a lot of heavy lifting. Other contributors include: Daegwon Chae, Mood Rowghani, Eric Feng (E-Commerce) & Noah Knauf (Healthcare). In addition, Bing Gordon, Ted Schlein, Ilya Fushman, Mamoon Hamid, Juliet deBaubigny, John Doerr, Bucky Moore, Josh Coyne, Lucas Swisher, Everett Randle & Amanda Duckworth were more than on call with help. Hillhouse Capital Liang Wu & colleagues’ contribution of the China section provides an overview of the world’s largest market of Internet users. Participants in Evolution of Internet Connectivity From creators to consumers who keep us on our toes 24x7 + the people who directly help us prepare the report. And, Kara & team, thanks for continuing to do what you do so well. 2

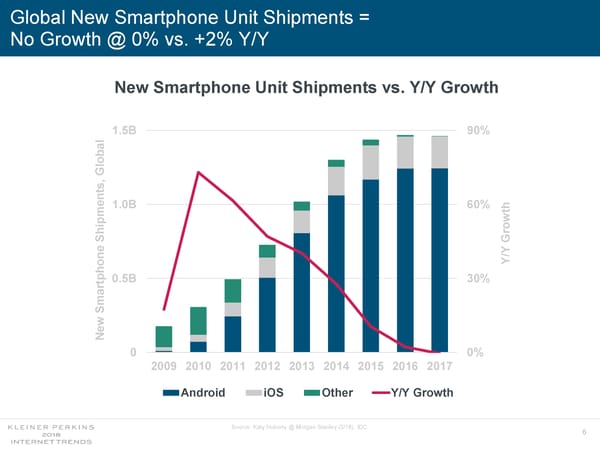

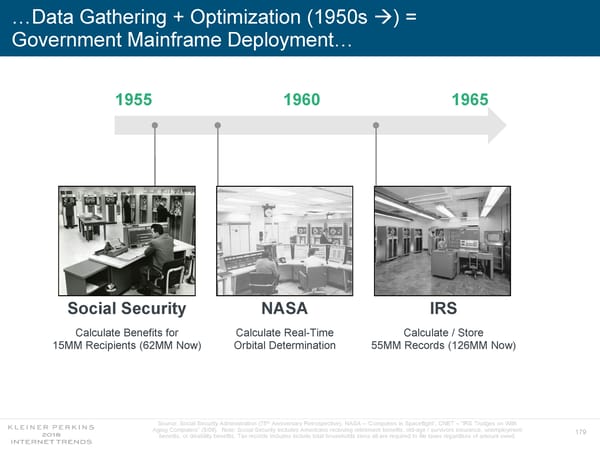

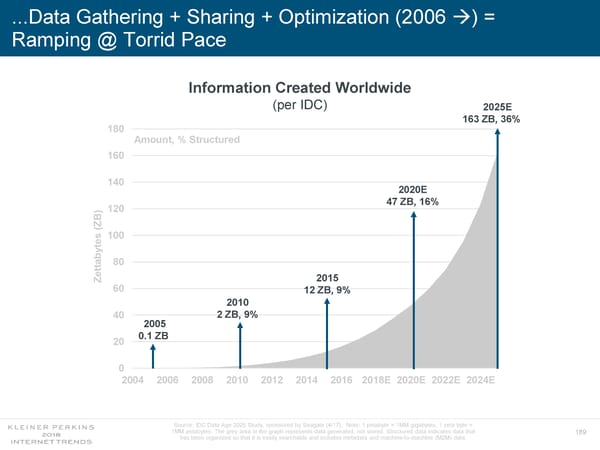

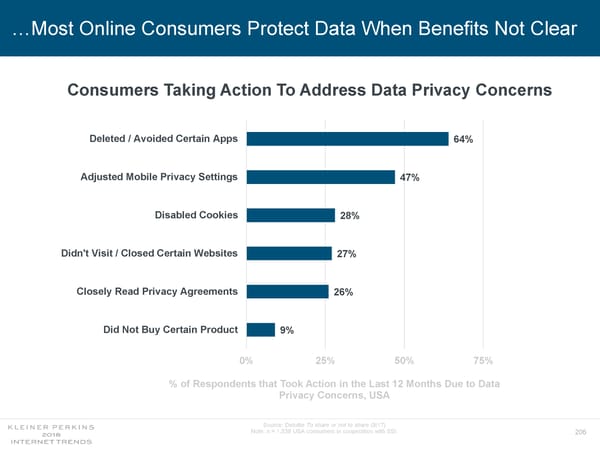

Context We use data to tell stories of business-related trends we focus on. We hope others take the ideas, build on them & make them better. At 3.6B, the number of Internet users has surpassed half the world’s population. When markets reach mainstream, new growth gets harder to find - evinced by 0% new smartphone unit shipment growth in 2017. Internet usage growth is solid while many believe it’s higher than it should be. Reality is the dynamics of global innovation & competition are driving product improvements, which, in turn, are driving usage & monetization. Many usability improvements are based on data - collected during the taps / clicks / movements of mobile device users. This creates a privacy paradox... Internet Companies continue to make low-priced services better, in part, from user data. Internet Users continue to increase time spent on Internet services based on perceived value. Regulators want to ensure user data is not used ‘improperly.’ Scrutiny is rising on all sides - users / businesses / regulators. Technology-driven trends are changing so rapidly that it’s rare when one side fully understands the other...setting the stage for reactions that can have unintended consequences. And, not all countries & actors look at the issues through the same lens. We focus on trends around data + personalization; high relative levels of tech company R&D + Capex Spending; E-Commerce innovation + revenue acceleration; ways in which the Internet is helping consumers contain expenses + drive income (via on-demand work) + find learning opportunities. We review the consumerization of enterprise software and, lastly, we focus on China’s rising intensity & leadership in Internet-related markets. 3

INTERNET DEVICES + USERS = GROWTH CONTINUES TO SLOW 5

Global New Smartphone Unit Shipments = No Growth @ 0% vs. +2% Y/Y New Smartphone Unit Shipments vs. Y/Y Growth 1.5B 90% al b Glo ts, n 1.0B 60% h t me w p i o Sh Gr e Y n o Y/ h 0.5B 30% artp Sm ew N 0 0% 2009 2010 2011 2012 2013 2014 2015 2016 2017 Android iOS Other Y/Y Growth Source: Katy Huberty @ Morgan Stanley (3/18), IDC. 6

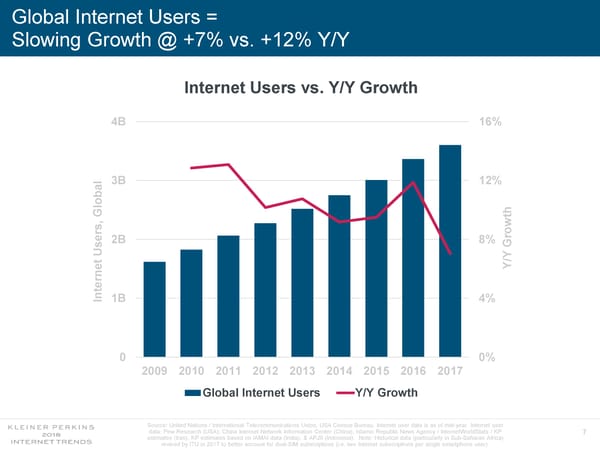

Global Internet Users = Slowing Growth @ +7% vs. +12% Y/Y Internet Users vs. Y/Y Growth 4B 16% 3B 12% al ob h Gl t w s, o 2B 8% Gr User Y Y/ net nter I 1B 4% 0 0% 2009 2010 2011 2012 2013 2014 2015 2016 2017 Global Internet Users Y/Y Growth Source: United Nations / International Telecommunications Union, USA Census Bureau. Internet user data is as of mid-year. Internet user data: Pew Research (USA), China Internet Network Information Center (China), Islamic Republic News Agency / InternetWorldStats / KP 7 estimates (Iran), KP estimates based on IAMAI data (India), & APJII (Indonesia). Note: Historical data (particularly in Sub-Saharan Africa) revised by ITU in 2017 to better account for dual-SIM subscriptions (i.e. two Internet subscriptions per single smartphone user).

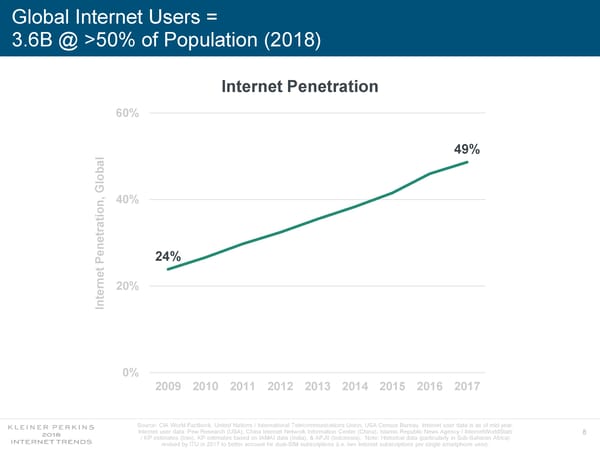

Global Internet Users = 3.6B @ >50% of Population (2018) Internet Penetration 60% 49% al b o Gl , 40% n o ati etr 24% Pen et n 20% ter n I 0% 2009 2010 2011 2012 2013 2014 2015 2016 2017 Source: CIA World Factbook, United Nations / International Telecommunications Union, USA Census Bureau. Internet user data is as of mid-year. Internet user data: Pew Research (USA), China Internet Network Information Center (China), Islamic Republic News Agency / InternetWorldStats 8 / KP estimates (Iran), KP estimates based on IAMAI data (India), & APJII (Indonesia). Note: Historical data (particularly in Sub-Saharan Africa) revised by ITU in 2017 to better account for dual-SIM subscriptions (i.e. two Internet subscriptions per single smartphone user).

Internet Users… Growth Harder to Find After Hitting 50% Market Penetration 9

INTERNET USAGE = GROWTH REMAINS SOLID 10

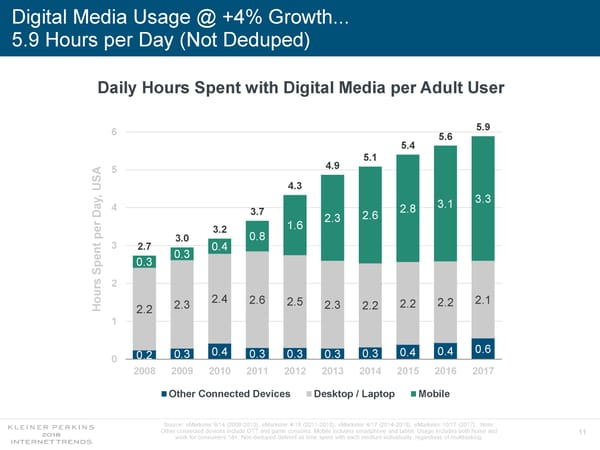

Digital Media Usage @ +4% Growth... 5.9 Hours per Day (Not Deduped) Daily Hours Spent with Digital Media per Adult User 5.9 6 5.6 5.4 5.1 4.9 5 SA U 4.3 , 3.3 3.1 ay 4 2.8 3.7 D 2.6 2.3 1.6 er 3.2 p 0.8 3.0 t 3 2.7 0.4 0.3 en 0.3 Sp s 2 r u o 2.4 2.6 2.1 2.5 2.2 2.2 2.3 2.3 2.2 H 2.2 1 0.6 0.4 0.4 0.4 0.3 0.3 0.3 0.3 0.3 0.2 0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Other Connected Devices Desktop / Laptop Mobile Source: eMarketer 9/14 (2008-2010), eMarketer 4/15 (2011-2013), eMarketer 4/17 (2014-2016), eMarketer 10/17 (2017). Note: Other connected devices include OTT and game consoles. Mobile includes smartphone and tablet. Usage includes both home and 11 work for consumers 18+. Non deduped defined as time spent with each medium individually, regardless of multitasking.

Internet Usage… How Much = Too Much? Depends How Time is Spent 12

INNOVATION + COMPETITION = DRIVING PRODUCT IMPROVEMENTS / USEFULNESS / USAGE + SCRUTINY 13

Innovation + Competition = Driving Product Improvements / Usefulness / Usage Devices Access Simplicity Payments Local Messaging Video Voice Personalization 14

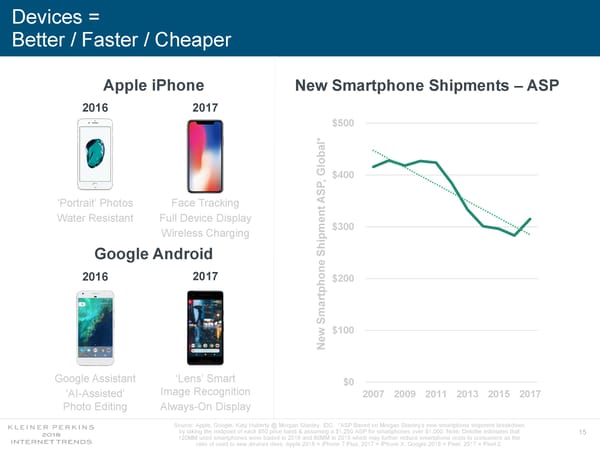

Devices = Better / Faster / Cheaper Apple iPhone New Smartphone Shipments –ASP 2016 2017 $500 * al lob G $400 , SP A ‘Portrait’ Photos Face Tracking nt Water Resistant Full Device Display $300 me Wireless Charging Ship Google Android ne 2016 2017 $200 rtpho Sma $100 New Google Assistant ‘Lens’ Smart $0 Image Recognition ‘AI-Assisted’ 2007 2009 2011 2013 2015 2017 Photo Editing Always-On Display Source: Apple, Google, Katy Huberty @ Morgan Stanley, IDC. *ASP Based on Morgan Stanley’s new smartphone shipment breakdown by taking the midpoint of each $50 price band & assuming a $1,250 ASP for smartphones over $1,000. Note: Deloitte estimates that 15 120MM used smartphones were traded in 2016 and 80MM in 2015 which may further reduce smartphone costs to consumers as the ratio of used to new devices rises. Apple 2016 = iPhone 7 Plus, 2017 = iPhone X. Google 2016 = Pixel, 2017 = Pixel 2.

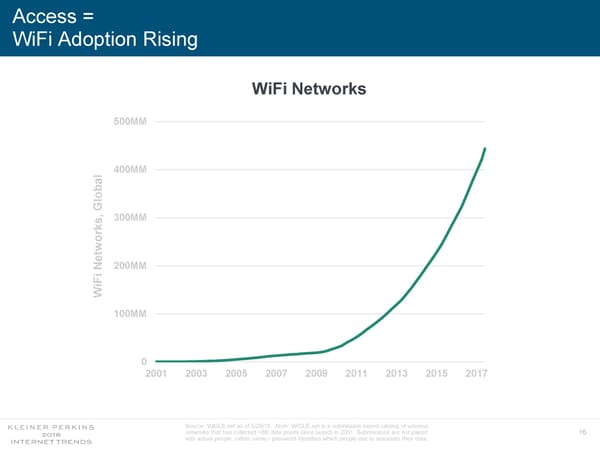

Access = WiFi Adoption Rising WiFi Networks 500MM 400MM al b o Gl 300MM ks, r o etw N 200MM i F i W 100MM 0 2001 2003 2005 2007 2009 2011 2013 2015 2017 Source: WiGLE.net as of 5/29/18. Note: WiGLE.net is a submission-based catalog of wireless networks that has collected >6B data points since launch in 2001. Submissions are not paired 16 with actual people, rather name / password identities which people use to associate their data.

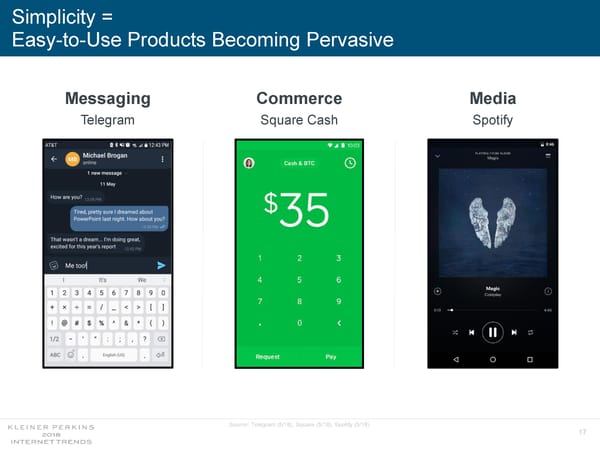

Simplicity = Easy-to-Use Products Becoming Pervasive Messaging Commerce Media Telegram Square Cash Spotify Source: Telegram (5/18), Square (5/18), Spotify (5/18). 17

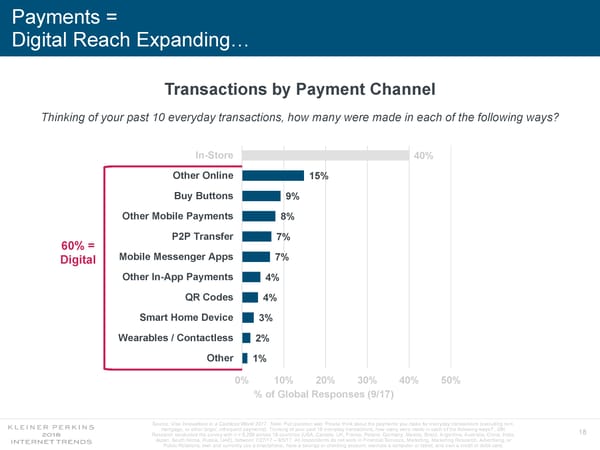

Payments = Digital Reach Expanding… Transactions by Payment Channel Thinking of your past 10 everyday transactions, how many were made in each of the following ways? In-Store In-Store 40% Other Online 15% Buy Buttons 9% Other Mobile Payments 8% P2P Transfer 7% 60% = Mobile Messenger Apps 7% Digital Other In-App Payments 4% QR Codes 4% Smart Home Device 3% Wearables / Contactless 2% Other 1% 0% 10% 20% 30% 40% 50% % of Global Responses (9/17) Source: Visa Innovations in a Cashless World 2017. Note: Full question was ‘Please think about the payments you make for everyday transactions (excluding rent, mortgage, or other larger, infrequent payments). Thinking of your past 10 everyday transactions, how many were made in each of the following ways?’, GfK 18 Research conducted the survey with n = 9,200 across 16 countries (USA, Canada, UK, France, Poland, Germany, Mexico, Brazil, Argentina, Australia, China, India, Japan, South Korea, Russia, UAE), between 7/27/17 – 9/5/17. All respondents do not work in Financial Services, Marketing, Marketing Research, Advertising, or Public Relations, own and currently use a smartphone, have a savings or checking account; own/use a computer or tablet, and own a credit or debit card.

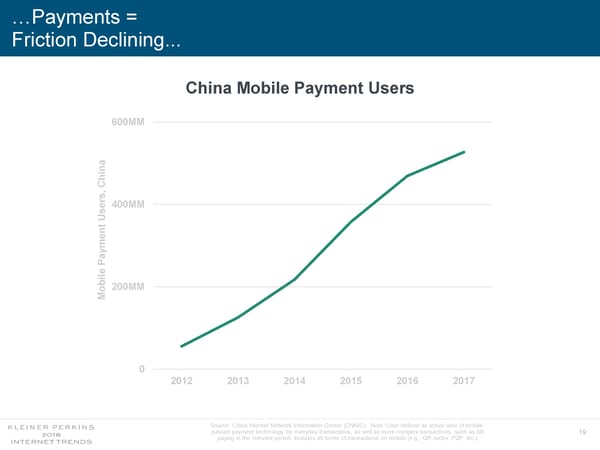

…Payments = Friction Declining... China Mobile Payment Users 600MM na Chi , s r e400MM Us nt me y a P e 200MM Mobil 0 2012 2013 2014 2015 2016 2017 Source: China Internet Network Information Center (CNNIC). Note: User defined as active user of mobile- passed payment technology for everyday transactions, as well as more complex transactions, such as bill 19 paying in the relevant period. Includes all forms of transactions on mobile (e.g., QR codes, P2P, etc.)

…Payments = Digital Currencies Emerging Coinbase Users ) 4x 17 1/ o t d Indexe ( 3x Global , rs se U ed 2x er t egis R e as 1x oinb C January March May July September November 2017 Source: Coinbase. Note: Registered users defined as users that have an account on Coinbase. 20

Local = Offline Connections Driven by Online Network Effects Nextdoor Active Neighborhoods 200K SA 150K s, U d o o h r o b 100K h eig N e ctiv 50K A 0 2011 2012 2013 2014 2015 2016 2017 2018 Source: Nextdoor (5/18). Note: There are ~130MM households in USA. Nextdoor estimates that there are ~650 households per average neighborhood (~200K USA neighborhoods). 21

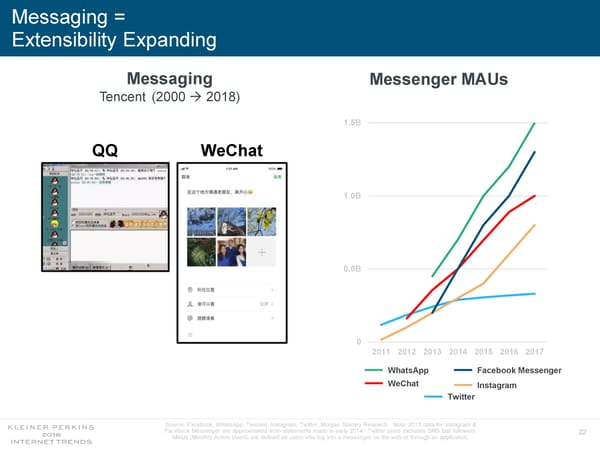

Messaging = Extensibility Expanding Messaging Messenger MAUs Tencent (2000 2018) 1.5B QQ WeChat 1.0B 0.5B 0 2011 2012 2013 2014 2015 2016 2017 WhatsApp Facebook Messenger WeChat Instagram Twitter Source: Facebook, WhatsApp, Tencent, Instagram, Twitter, Morgan Stanley Research. Note: 2013 data for Instagram & Facebook Messenger are approximated from statements made in early 2014. Twitter users excludes SMS fast followers. 22 MAUs (Monthly Active Users) are defined as users who log into a messenger on the web or through an application.

Video = Mobile Adoption Climbing... Mobile Video Usage 40 obal Gl , 30 inutes M ing w ie20 o V ide V obile10 M ly Dai 0 2012 2013 2014 2015 2016 2017 2018E Source: Zenith Online Video Forecasts 2017 (7/17). Note: Based on a study across 63 countries. The historical figures are taken from the most reliable third-party sources in each market including Nielsen 23 and comScore. The forecasts are provided by local experts, based on the historical trends, comparisons with the adoption of previous technologies, and their judgement.

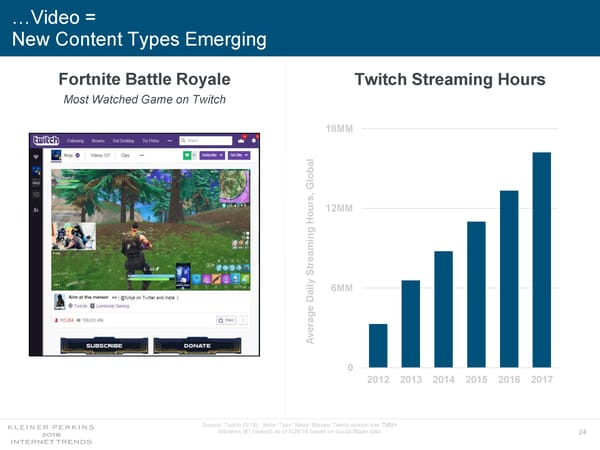

…Video = New Content Types Emerging Fortnite Battle Royale Twitch Streaming Hours Most Watched Game on Twitch 18MM obal Gl , urs12MM Ho ming trea S ly 6MM Dai ge ra e v A 0 2012 2013 2014 2015 2016 2017 Source: Twitch (3/18). Note: Tyler “Ninja” Blevins Twitch stream has 7MM+ followers (#1 ranked) as of 5/29/18 based on Social Blade data. 24

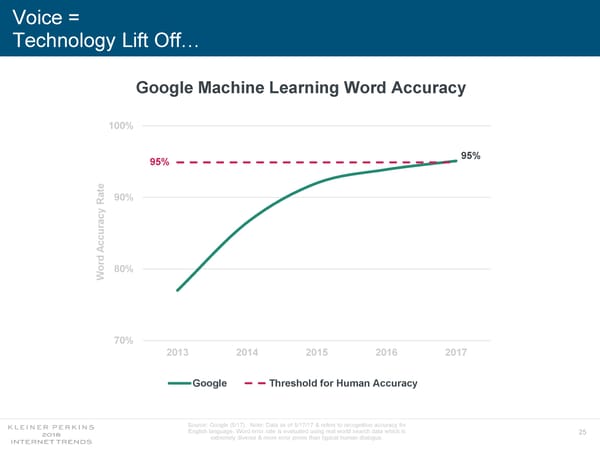

Voice = Technology Lift Off… Google Machine Learning Word Accuracy 100% 95% 95% 90% Rate y c ura c c A ord 80% W 70% 2013 2014 2015 2016 2017 Google Threshold for Human Accuracy Source: Google (5/17). Note: Data as of 5/17/17 & refers to recognition accuracy for English language. Word error rate is evaluated using real world search data which is 25 extremely diverse & more error prone than typical human dialogue.

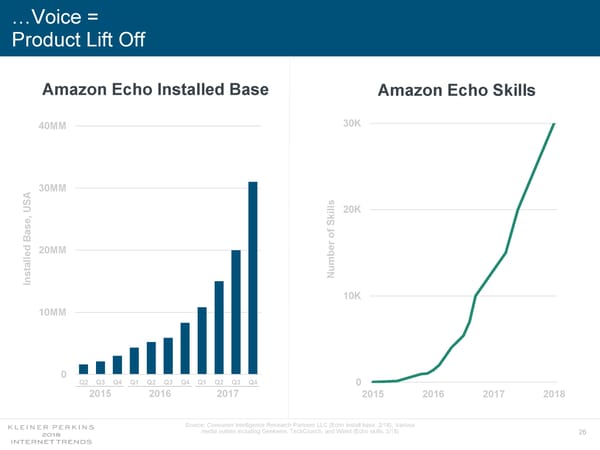

…Voice = Product Lift Off Amazon Echo Installed Base Amazon Echo Skills 30K 40MM 30MM ls USA il20K , k e Bas r of S d 20MM e mbe tall Nu Ins 10K 10MM 0 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 0 2015 2016 2017 2015 2016 2017 2018 Source: Consumer Intelligence Research Partners LLC (Echo install base, 2/18), Various media outlets including Geekwire, TechCrunch, and Wired (Echo skills, 3/18) 26

Innovation + Competition = Driving Product Improvements / Usefulness / Usage Devices Access Simplicity Payments Local Messaging Video Voice Personalization 27

Personalization = Data Improves Engagement + Experiences… Drives Growth + Scrutiny 28

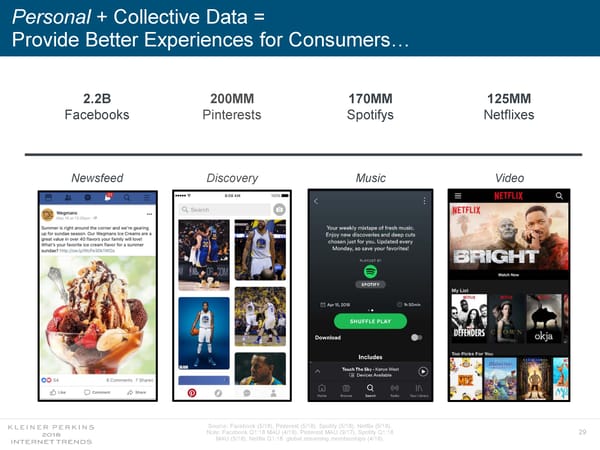

Personal + Collective Data = Provide Better Experiences for Consumers… 2.2B 200MM 170MM 125MM Facebooks Pinterests Spotifys Netflixes Newsfeed Discovery Music Video Source: Facebook (5/18), Pinterest (5/18), Spotify (5/18), Netflix (5/18). Note: Facebook Q1:18 MAU (4/18), Pinterest MAU (9/17), Spotify Q1:18 29 MAU (5/18), Netflix Q1:18 global streaming memberships (4/18).

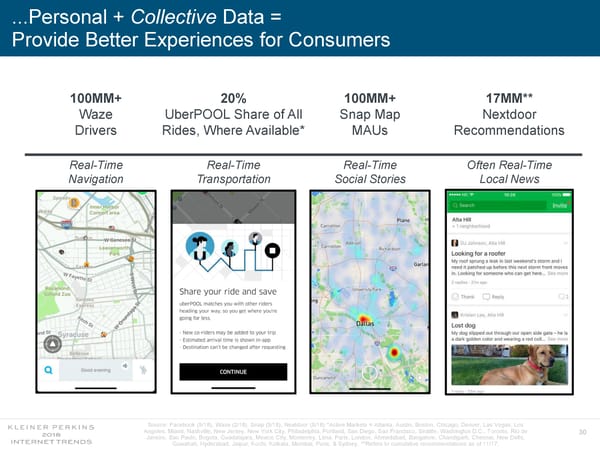

...Personal + Collective Data = Provide Better Experiences for Consumers 100MM+ 20% 100MM+ 17MM** Waze UberPOOL Share of All Snap Map Nextdoor Drivers Rides, Where Available* MAUs Recommendations Real-Time Real-Time Real-Time Often Real-Time Navigation Transportation Social Stories Local News Source: Facebook (5/18), Waze (2/18), Snap (5/18), Nextdoor (5/18) *Active Markets = Atlanta, Austin, Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, Nashville, New Jersey, New York City, Philadelphia, Portland, San Diego, San Francisco, Seattle, Washington D.C., Toronto, Rio de 30 Janeiro, Sao Paulo, Bogota, Guadalajara, Mexico City, Monterrey, Lima, Paris, London, Ahmedabad, Bangalore, Chandigarh, Chennai, New Delhi, Guwahati, Hyderabad, Jaipur, Kochi, Kolkata, Mumbai, Pune, & Sydney. **Refers to cumulative recommendations as of 11/17.

Privacy Paradox Internet Companies Making Low-Priced Services Better, in Part, from User Data Internet Users Increasing Time on Internet Services Based on Perceived Value Regulators Want to Ensure User Data is Not Used ‘Improperly’ 31

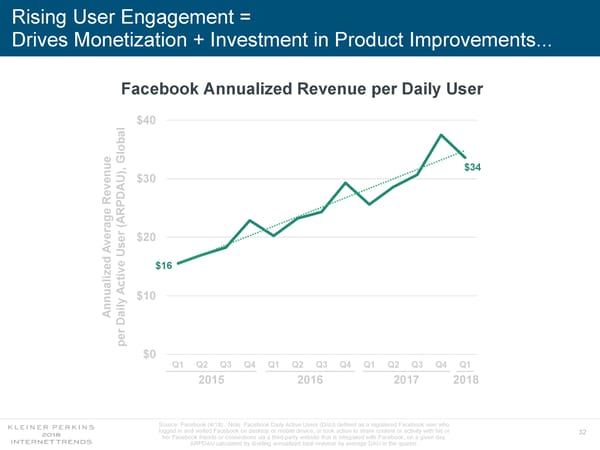

Rising User Engagement = Drives Monetization + Investment in Product Improvements... Facebook Annualized Revenue per Daily User $40 al b o e Gl u $34 ), en U $30 A ev R PD e R ag (A er $20 v ser A U e ed $16 v z i cti al u A $10 n y l n A ai D er p $0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2015 2016 2017 2018 Source: Facebook (4/18). Note: Facebook Daily Active Users (DAU) defined as a registered Facebook user who logged in and visited Facebook on desktop or mobile device, or took action to share content or activity with his or 32 her Facebook friends or connections via a third-party website that is integrated with Facebook, on a given day. ARPDAU calculated by dividing annualized total revenue by average DAU in the quarter.

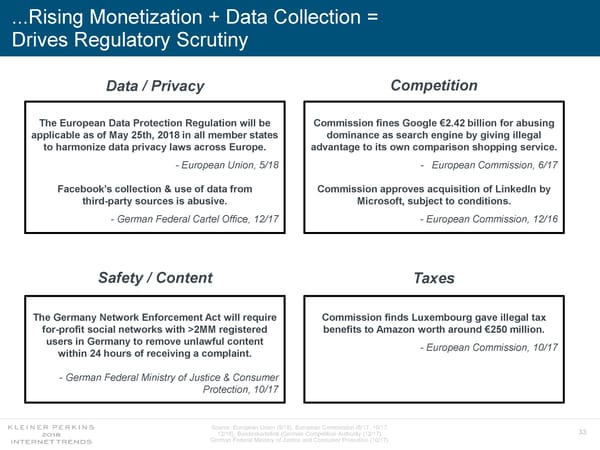

...Rising Monetization + Data Collection = Drives Regulatory Scrutiny Data / Privacy Competition The European Data Protection Regulation will be Commission fines Google €2.42 billion for abusing applicable as of May 25th, 2018 in all member states dominance as search engine by giving illegal to harmonize data privacy laws across Europe. advantage to its own comparison shopping service. - European Union, 5/18 - European Commission, 6/17 Facebook’s collection & use of data from Commission approves acquisition of LinkedIn by third-party sources is abusive. Microsoft, subject to conditions. - German Federal Cartel Office, 12/17 - European Commission, 12/16 Safety / Content Taxes The Germany Network Enforcement Act will require Commissionfinds Luxembourg gave illegal tax for-profit social networks with >2MM registered benefits to Amazon worth around €250 million. users in Germany to remove unlawful content - European Commission, 10/17 within 24 hours of receiving a complaint. - German Federal Ministry of Justice & Consumer Protection, 10/17 Source: European Union (5/18), European Commission (6/17, 10/17, 33 12/16), Bundeskartellmt (German Competition Authority (12/17). German Federal Ministry of Justice and Consumer Protection (10/17).

Internet Companies = Key to Understand Unintended Consequences of Products... We’re an idealistic & optimistic company. For the first decade, we really focused on all the good that connecting people brings. But it’s clear now that we [Facebook] didn’t do enough. We didn’t focus enough on preventing abuse & thinking through how people could use these tools to do harm as well. - Mark Zuckerberg, Facebook CEO, 4/18 Source: Facebook (4/18). 34

…Regulators = Key to Understand Unintended Consequences of Regulation This month, the European Union will embark on an expansive effort to give people more control over their data online... As it comes into force, Europe should be mindful of unintended consequences & open to change when things go wrong. - Bloomberg Opinion Editorial, 5/8/18 Source: Bloomberg (5/18). 35

It’s Crucial To Manage For Unintended Consequences… But It’s Irresponsible to Stop Innovation + Progress 36

USA Internet Leaders = Aggressive + Forward-Thinking Investors for Years 37

Investment (Public + Private) Into Technology Companies = High for Two Decades Global USA-Listed Technology IPO Issuance & Global Technology Venture Capital Financing $200B 8,000 obal Gl ing, $150B 6,000 ite nc Fina mpos te a Co $100B 4,000 iv r Q P DA & S O NA IP $50B 2,000 hnology c e T $0 0 1990 1995 2000 2005 2010 2015 2018YTD* Technology Private Financing Technology IPO NASDAQ Source: Morgan Stanley Equity Capital Markets, *2018YTD figure as of 5/25/18, Thomson ONE. All global USA-listed technology IPOs over $30MM, data per Dealogic, Bloomberg, & Capital IQ. 2012: Facebook ($16B IPO) = 75% of 2012 38 IPO $ value. 2014: Alibaba ($25B IPO) = 69% of 2014 IPO $ value. 2017: Snap ($4B IPO) = 34% of 2017 $ value.

Technology Companies = 25% & Rising % of Market Cap, USA USA Information Technology % of MSCI Market Capitalization 40% 33% USA March, 2000 , on ati 30% 25% iz April, 2018 tal Capi et 20% ark M SCI M 10% of % IT 0% 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 Source: FactSet, Katy Huberty @ Morgan Stanley. MSCI, Formerly Morgan Stanley Capital International = American provider of equity, fixed income, hedge fund stock market indexes, and 39 equity portfolio analysis tools. Data refers to MSCI’s index of USA publicly traded companies.

Technology Companies = 6 of Top 15 R&D + Capex Spenders, USA USA Public Company Research & Development Spend + Capital Expenditures (2017) Amazon Amazon +45% Y/Y Google / Alphabet Google / Alphabet +23% Intel Intel +11% Apple +5% Apple Microsoft Microsoft +6% AT&T -4% Verizon +1% Exxon Mobil -4% General Motors +5% Ford +5% Facebook +40% Facebook Chevron -26% Johnson & Johnson +12% General Electric +2% Merck +3% $0 $10B $20B $30B $40B 2017 R&D + Capex Capex R&D Source: SEC Edgar, Katy Huberty @ Morgan Stanley. Note: All figures are calendar year 2017. Amazon R&D = Tech & Content spend. General Motors does not include purchases of leased vehicles. AT&T capex does not include interest 40 during construction, just purchases of property, plant, & equipment. Verizon capitalizes R&D expense (i.e. reported as capex). General Electric R&D = GE funded, not government or customer. Bold indicates tech companies.

Technology Companies = Largest + Fastest Growing R&D + Capex Spenders, USA Research & Development Spend + Capital Expenditures – Select USA GICS Sectors $300B Technology +9% CAGR +18% Y/Y USA , x $200B Cape Healthcare* D + +4% CAGR R& +8% Y/Y $100B Discretionary 0% CAGR -22% Y/Y $0 2007 2009 2011 2013 2015 2017 Technology Healthcare Energy Materials Industrials Discretionary Staples Utilities Telecom Source: ClariFi, Katy Huberty @ Morgan Stanley. GICS = Global Industry Classification Standard, an industry taxonomy developed in 1999 by MSCI and Standard & Poor's (S&P) for use by the global financial community. CAGR = Compounded annual growth rate from 2007-2017. Note: Amazon, Netflix and Expedia removed from Discretionary 41 Sector & added to Technology. Discretionary includes companies that sell goods & services that are considered non-essential by consumers such as Starbucks (restaurants) & Nike (apparel). See appendix for detailed GICs definition. ClariFi does not have R&D or Capex data from Financial Services. *Healthcare Includes pharmaceutical companies.

Technology Companies = Rising R&D + Capex as % of Revenue…18% vs. 13% (2007) USA Technology Company Research & Development Spend + Capital Expenditures vs. % of Revenue $800B 20% 18% $600B 15% USA 13% x, ue en Cape $400B 10% Rev + of R&D % $200B 5% $0 0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 R&D + Capex % of Revenue Source: ClariFi, Katy Huberty @ Morgan Stanley. GICS = Global Industry Classification Standard, an industry taxonomy developed in 1999 by MSCI and Standard & Poor's (S&P) for use by the global financial community. Note: Amazon, Netflix and Expedia removed 42 from Discretionary Sector & added to Technology. Discretionary includes companies that sell goods & services that are considered non-essential by consumers such as Starbucks (restaurants) & Nike (apparel). See appendix for detailed GICs definition.

USA Tech Companies… Aggressive Competition + Spending on R&D + Capex = Driving Innovation + Growth 43

E-COMMERCE = TRANSFORMATION ACCELERATING 44

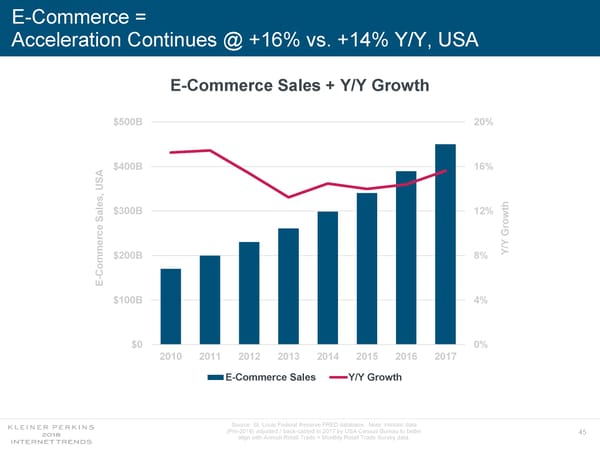

E-Commerce = Acceleration Continues @ +16% vs. +14% Y/Y, USA E-Commerce Sales + Y/Y Growth $500B 20% $400B 16% USA , s le th a $300B 12% S e Grow rc /Y Y $200B 8% mme Co - E $100B 4% $0 0% 2010 2011 2012 2013 2014 2015 2016 2017 E-Commerce Sales Y/Y Growth Source: St. Louis Federal Reserve FRED database. Note: Historic data (Pre-2016) adjusted / back-casted in 2017 by USA Census Bureau to better 45 align with Annual Retail Trade + Monthly Retail Trade Survey data.

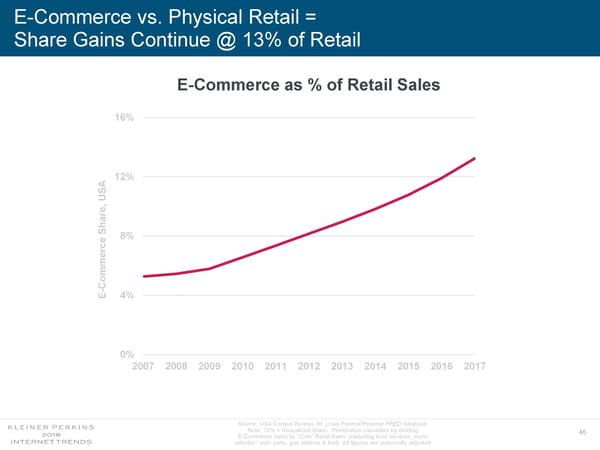

E-Commerce vs. Physical Retail = Share Gains Continue @ 13% of Retail E-Commerce as % of Retail Sales 16% 12% SA U , Share 8% ce er omm C - E 4% 0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Source: USA Census Bureau, St. Louis Federal Reserve FRED database. Note: 13% = Annualized share. Penetration calculated by dividing 46 E-Commerce sales by “Core” Retail Sales (excluding food services, motor vehicles / auto parts, gas stations & fuel). All figures are seasonally adjusted.

Amazon = E-Commerce Share Gains Continue @ 28% vs. 20% in 2013 E-Commerce Gross Merchandise Value (GMV) – Amazon vs. Other Other 100% 2013 80% USA 2017 , e rc 60% mme Amazon Co - E 40% of re 2017 ha $129B GMV = 28% Share S 20% 2013 $52B GMV = 20% Share 0% $0 $100B $200B $300B $400B $500B GMV Source: St. Louis Federal Reserve FRED database, Brian Nowak @ Morgan Stanley (5/18). Morgan Stanley Amazon USA GMV estimates exclude in-store GMV and assume 90% of 47 North American GMV is USA. Market share calculated using FRED E-Commerce sales data.

E-Commerce = Evolving + Scaling 48

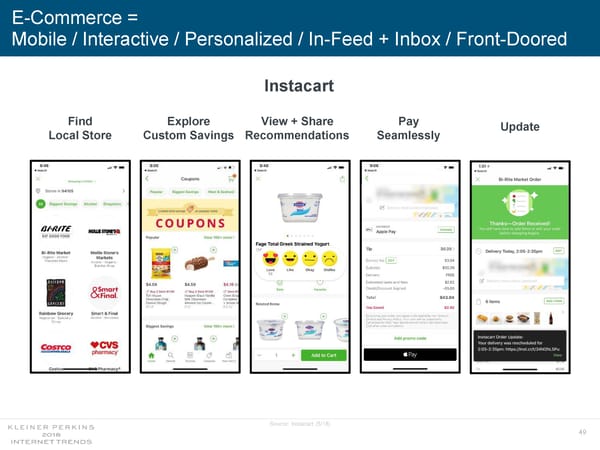

E-Commerce = Mobile / Interactive / Personalized / In-Feed + Inbox / Front-Doored Instacart Find Explore View + Share Pay Update Local Store Custom Savings Recommendations Seamlessly Source: Instacart (5/18) 49

E-Commerce = A Look @ Tools + Numbers… Payment Online Store Online Payment Fraud Prevention Purchase Financing Customer Support Finding Customers Delivering Product 50

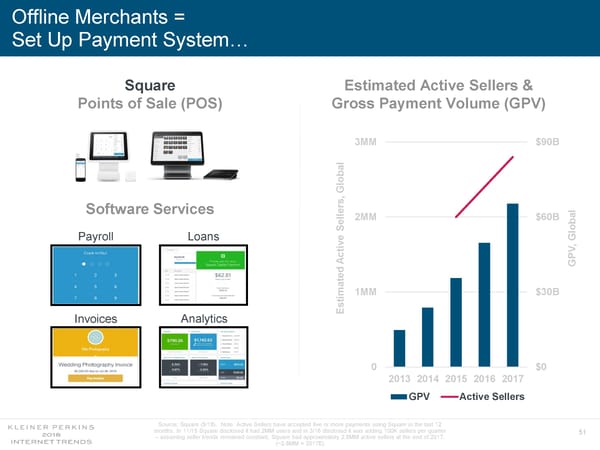

Offline Merchants = Set Up Payment System… Square Estimated Active Sellers & Points of Sale (POS) Gross Payment Volume (GPV) 3MM $90B obal Gl , rs Software Services e ll 2MM $60B e S obal Payroll Loans e Gl , tiv V c A GP ted 1MM $30B tima s E Invoices Analytics 0 $0 2013 2014 2015 2016 2017 GPV Active Sellers Source: Square (5/18). Note: Active Sellers have accepted five or more payments using Square in the last 12 months. In 11/15 Square disclosed it had 2MM users and in 3/16 disclosed it was adding 100K sellers per quarter 51 – assuming seller trends remained constant, Square had approximately 2.8MM active sellers at the end of 2017. (~2.8MM = 2017E)

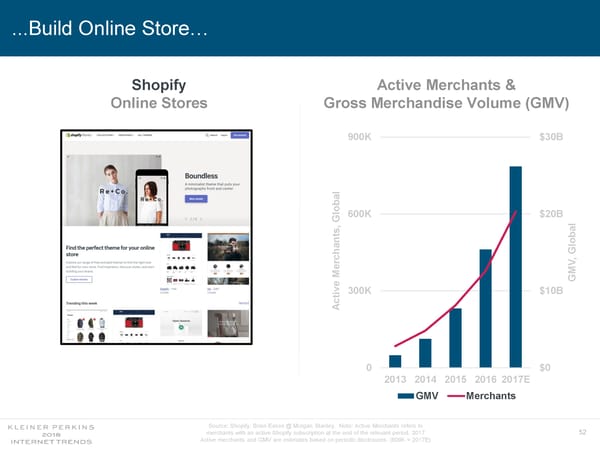

...Build Online Store… Shopify Active Merchants & Online Stores Gross Merchandise Volume (GMV) 900K $30B obal 600K $20B Gl , s nt obal ha Gl , rc e M GMV e 300K $10B tiv c A 0 $0 2013 2014 2015 2016 2017E GMV Merchants Source: Shopify, Brian Essex @ Morgan Stanley. Note: Active Merchants refers to merchants with an active Shopify subscription at the end of the relevant period. 2017 52 Active merchants and GMV are estimates based on periodic disclosures. (609K = 2017E)

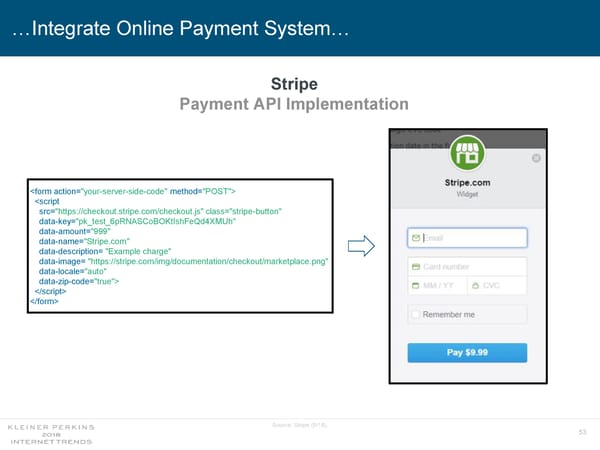

…Integrate Online Payment System… Stripe Payment API Implementation Source: Stripe (5/18). 53

...Integrate Fraud Prevention… Merchants Signifyd Fraud Prevention 12K Increase Revenue obal 8K Gl , s nt Fast Decisions (milliseconds) ha rc e M e tiv4K c A Shift Liability 0 2015 2016 2017 Source: Signifyd (5/18). Note: Merchants refers to retailers using Signifyd services to monitor for fraud @ period end. (10K = 2017) 54

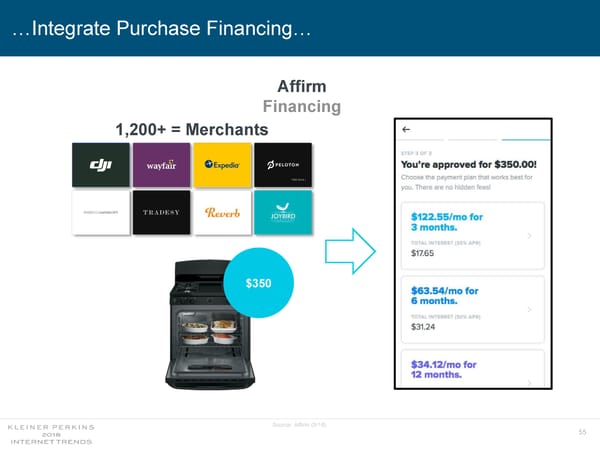

…Integrate Purchase Financing… Affirm Financing 1,200+ = Merchants $350 Source: Affirm (5/18). 55

…Integrate Customer Support… Intercom Customer Conversations Real-Time Support 500MM 400MM obal Gl d, 300MM tarte S tions a 200MM rs e nv Co 100MM 0 2013 2014 2015 2016 2017 2018 Source: Intercom (5/18). Note: Conversations started include messages initiated by business & customers. (500MM = 2018) 56

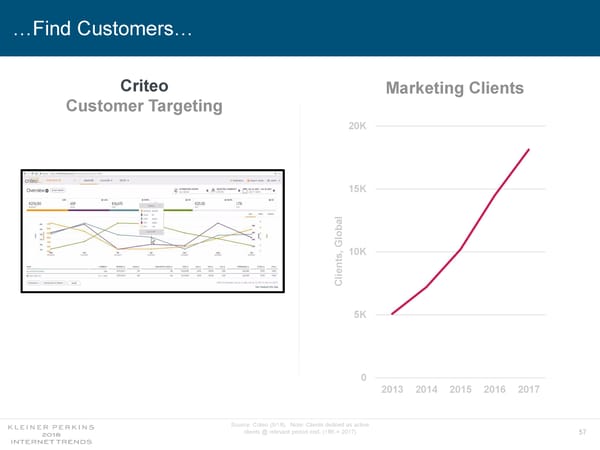

…Find Customers… Criteo Marketing Clients Customer Targeting 20K 15K obal Gl , 10K s nt Clie 5K 0 2013 2014 2015 2016 2017 Source: Criteo (5/18). Note: Clients defined as active clients @ relevant period end. (18K = 2017) 57

…Deliver Products to Customers Product Delivery Parcel Volume UPS + FedEx + USPS* 12B 10B 8B * USA , 6B me olu V 4B 2B 0 2012 2013 2014 2015 2016 2017 USPS UPS FedEx Source: UPS, FedEx, USPS, Caviar. *Combines USPS's domestic shipping & package services volumes, FedEx's domestic package volumes, and UPS's 58 domestic package volumes. All figures are calendar year end except FedEx which includes LTM figures ending November 30 due to offset fiscal year.

…E-Commerce = A Look @ Tools + Numbers Payment Online Store Online Payment Fraud Prevention Purchase Financing Customer Support Finding Customers Delivering Product 59

Building / Deploying Online Stores = Trend Evinced by Shopify Storefront Exchange Shopify Storefront Exchange (Launched 6/17) Loopies.com Source: Shopify (5/18) 60

Online Product Finding Evolution = Search Leads… Discovery Emerging Getting More... Data Driven / Personalized / Competitive 61

Product Finding = Often Starts @ Search (Amazon + Google...) Where Do You Begin Your Product Search? 49% Amazon 15% Other 36% Search Engine Source: Survata (9/17). Note: n = 2,000 USA customers. 62

Product Finding (Amazon) = Started @ Search...Fulfilled by Amazon Product Search 1-Click Purchasing Prime Fulfillment Sponsored Product Listings Voice Search + Fulfillment Source: The Internet Archive, Amazon. 63

Product Finding (Google) = Started @ Search...Fulfilled by Others Organic Search Paid Search Google Shopping Product Listing Ads Shopping Actions Source: The Internet Archive, Google. 64

Online Product Finding Evolution = Search Leads… Discovery Emerging Getting More... Data Driven / Personalized / Competitive 65

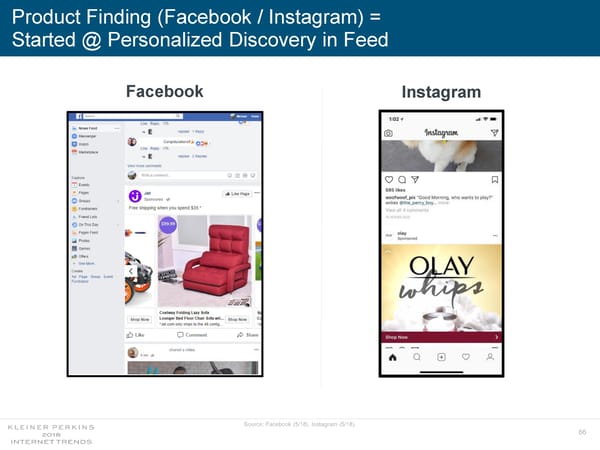

Product Finding (Facebook / Instagram) = Started @ Personalized Discovery in Feed Facebook Instagram Source: Facebook (5/18), Instagram (5/18). 66

Online Product Finding Evolution = Search Leads… Discovery Emerging Getting More... Data Driven / Personalized / Competitive 67

Google = Ad Platform to a Commerce Platform... Amazon = Commerce Platform to an Ad Platform 1997…2000 2018 AdWords Google Home Ordering Google 1-Click Checkout Sponsored Products Amazon Source: Advia (Google 2000 image), TechCrunch (2/17), Amazon (5/18). 68

E-Commerce-Related Advertising Revenue = Rising @ Google + Amazon + Facebook Google Amazon Facebook 3x = Engagement Increase $4B +42% Y/Y = >80MM +23% Y/Y = For Top Mobile Product Listing Ad* Ad Revenue SMBs with Pages Source: Google (7/17), Brian Nowak @ Morgan Stanley (Amazon Ad revenue estimate, 5/18), Facebook (4/18). *Google disclosed that the leftmost listing in a mobile product listing ad experiences 3x engagement. 69

Social Media = Enabling More Efficient Product Discovery / Commerce 70

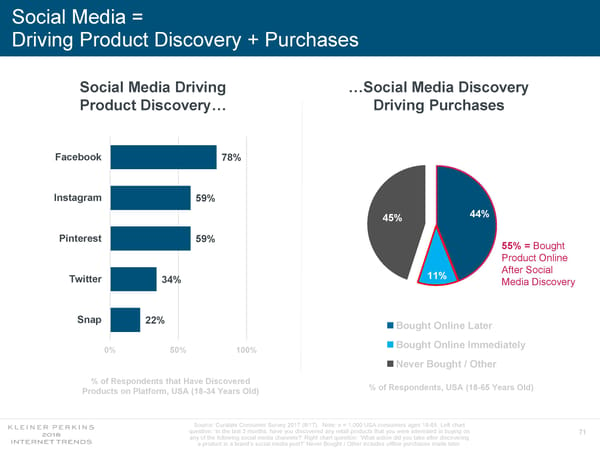

Social Media = Driving Product Discovery + Purchases Social Media Driving …Social Media Discovery Product Discovery… Driving Purchases Facebook 78% Instagram 59% 44% 45% Pinterest 59% 55% = Bought Product Online After Social 11% Twitter 34% Media Discovery Snap 22% Bought Online Later Bought Online Immediately 0% 50% 100% Never Bought / Other % of Respondents that Have Discovered % of Respondents, USA (18-65 Years Old) Products on Platform, USA (18-34 Years Old) Source: Curalate Consumer Survey 2017 (8/17). Note: n = 1,000 USA consumers ages 18-65. Left chart question: ‘In the last 3 months, have you discovered any retail products that you were interested in buying on 71 any of the following social media channels?’ Right chart question: ‘What action did you take after discovering a product in a brand’s social media post?’ Never Bought / Other includes offline purchases made later.

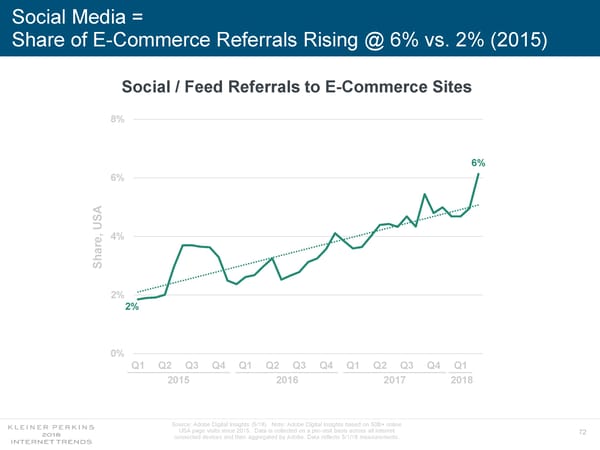

Social Media = Share of E-Commerce Referrals Rising @ 6% vs. 2% (2015) Social / Feed Referrals to E-Commerce Sites 8% 6% 6% SA U 4% e, ar Sh 2% 2% 0% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2015 2016 2017 2018 Source: Adobe Digital Insights (5/18). Note: Adobe Digital Insights based on 50B+ online USA page visits since 2015. Data is collected on a per-visit basis across all internet 72 connected devices and then aggregated by Adobe. Data reflects 5/1/18 measurements.

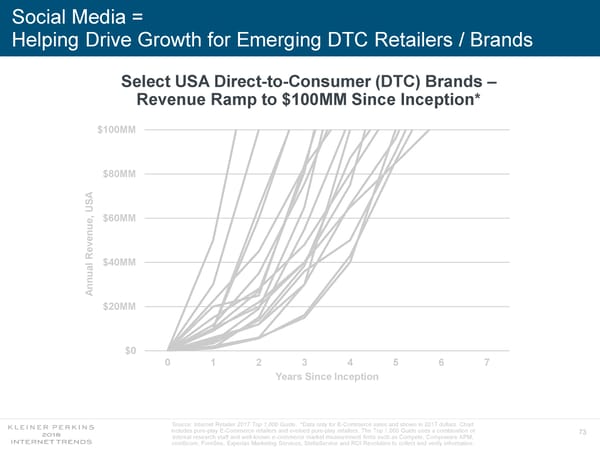

Social Media = Helping Drive Growth for Emerging DTC Retailers / Brands Select USA Direct-to-Consumer (DTC) Brands – Revenue Ramp to $100MM Since Inception* $100MM $80MM A US $60MM nue, e Rev $40MM nnual A $20MM $0 0 1 2 3 4 5 6 7 Years Since Inception Source: Internet Retailer 2017 Top 1,000 Guide. *Data only for E-Commerce sales and shown in 2017 dollars. Chart includes pure-play E-Commerce retailers and evolved pure-play retailers. The Top 1,000 Guide uses a combination of 73 internal research staff and well-known e-commerce market measurement firms such as Compete, Compuware APM, comScore, ForeSee, Experian Marketing Services, StellaService and ROI Revolution to collect and verify information.

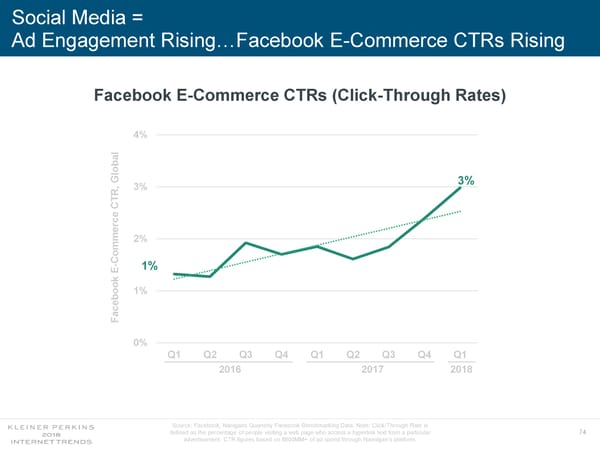

Social Media = Ad Engagement Rising…Facebook E-Commerce CTRs Rising Facebook E-Commerce CTRs (Click-Through Rates) 4% l loba 3% 3% R, G CT e rc 2% mme Co - 1% E 1% book e c Fa 0% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2016 2017 2018 Source: Facebook, Nanigans Quarterly Facebook Benchmarking Data. Note: Click-Through Rate is defined as the percentage of people visiting a web page who access a hyperlink text from a particular 74 advertisement. CTR figures based on $600MM+ of ad spend through Nannigan’s platform.

Return on Ad Spend = Cost Rising @ Faster Rate than Reach Facebook E-Commerce eCPM vs. CTR Y/Y Growth eCPM = +112% 120% In performance-based 80% [digital advertising] channels, CTR = +61% competition for top placement has obal Gl , reduced ROIs over the years & th40% been a source of margin pressure… Grow /Y - Glenn D. Fogel, CEO & President, Booking Holdings Y 0% Q3:17 Earnings Call, (11/17) -40% Q1 Q2 Q3 Q4 Q1 2017 2018 eCPM CTR Source: Booking Holdings Inc. (11/17), Nanigans Quarterly Facebook Benchmarking Data. Note: eCPMs are defined as the effective (blended across ad formats) cost per thousand ad impressions. Click-Through Rate is defined as the percentage of people visiting a web page who access a hyperlink text from a particular advertisement. CTR 75 figures based on $600MM+ of ad spend through Nanigan’s platform. In 2017, Booking Holdings spent $4.1B on online performance advertising which is primarily focused on search engine marketing (SEM) channels. The quote on the left relates to historical long-term ad ROI trends as competition across performance channels intensified.

Customer Lifetime Value (LTV) = Importance Rising as... Customer Acquisition Cost (CAC) Increases What Do You Consider To Be Important Ad Spending Optimization Metrics? Customer Lifetime Value 27% Impressions / Web Traffic 19% Brand Recognition & Lift 18% Closed-Won Business 15% Last-Click Attribution 13% Multi-touch Attribution 8% 0% 10% 20% 30% % of Respondents, Global Source: Salesforce Digital Advertising 2020 Report (1/18). Note: n = 900 full-time advertisers, media buyers, and marketers with the title of manager and above. Respondents are from companies in North America (USA, 76 Canada), Europe (France, Germany, Netherlands, UK, Ireland) and Asia Pacific (Japan, Australia, New Zealand) with each region having 300 participants. The survey was done online via FocusVision in 11/17.

Lifetime Value / Customer Acquisition Cost (LTV / CAC) = Increasingly Important Metric for Retailers / Brands Facebook Ad Analytics Tools LTV Integration Source: Facebook (3/17). 77

Data-Driven Personalization / Recommendations = Early Innings @ Scale 78

Evolution of Commerce Drivers (1890s -> 2010s) = Demographic -> Brand -> Utility -> Data 1890s - 1940s 1940s - 1990s 1990s - 2010s 2010s - … Demographic Brand Utility Data Catalogs DepartmentStores / E-Commerce – E-Commerce – Malls Transactional Personalized Limited product Rising product Massive product Curated product selection + selection + selection + 24x7 discovery + 24x7 shopping moments shoppingmoments shopping moments recommendations • Macy’s • Amazon • Sears Roebuck • Amazon • GAP • Facebook • MontgomeryWard • eBay • Nike • Stitch Fix Source: Eric Feng @ Kleiner Perkins Wikimedia, eBay, Stitch Fix. 79

Product Purchases = Many Evolving from Buying to Subscribing 80

Subscription Service Growth = Driven by... Access / Selection / Price / Experience / Personalization Online Subscription Services Subscribers Growth Representative Companies 2017 Y/Y Netflix Video 118MM +25% Amazon Commerce/ Media 100MM -- Spotify Music / Audio 71MM +48% Sony PlayStation Plus Gaming 34MM +30% Dropbox File Storage 11MM +25% The New York Times News / Media 3MM +43% Stitch Fix Fashion / Clothing 3MM +31% LegalZoom Legal Services 550K +16% Peloton Fitness 172K +173% Source: Netflix, Amazon, Spotify, Sony, Dropbox, The New York Times, Stitch Fix, LegalZoom, Peloton. Note: Netflix = global streaming memberships. The New York Times = digital subscribers. Sony PlayStation 81 Plus figures reflect FY, which ends March 31. Stitch Fix figures reflect FY, which ends January 31.

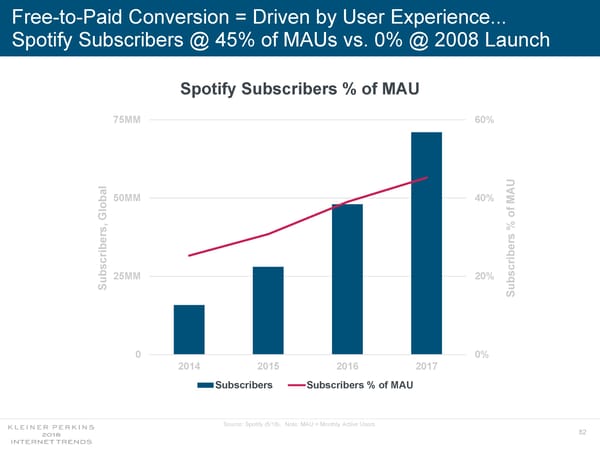

Free-to-Paid Conversion = Driven by User Experience... Spotify Subscribers @ 45% of MAUs vs. 0% @ 2008 Launch Spotify Subscribers % of MAU 75MM 60% U al A 50MM 40% M lob of G , % ers ers crib crib 25MM 20% Subs Subs 0 0% 2014 2015 2016 2017 Subscribers Subscribers % of MAU Source: Spotify (5/18). Note: MAU = Monthly Active Users. 82

Shopping = Entertainment… 83

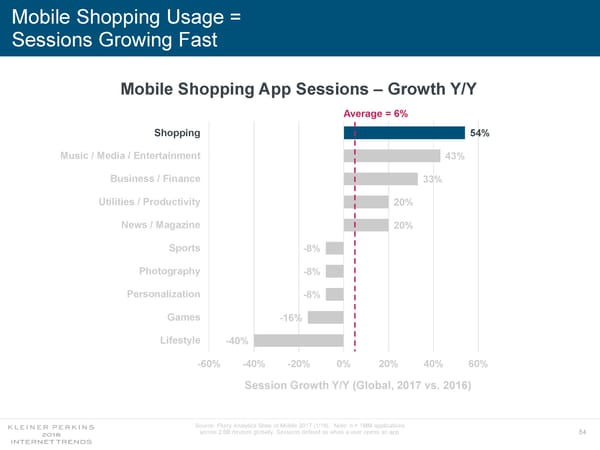

Mobile Shopping Usage = Sessions Growing Fast Mobile Shopping App Sessions – Growth Y/Y Average = 6% Shopping Shopping 54% Music / Media / Entertainment 43% Business / Finance 33% Utilities / Productivity 20% News / Magazine 20% Sports -8% Photography -8% Personalization -8% Games -16% Lifestyle -40% -60% -40% -20% 0% 20% 40% 60% Session Growth Y/Y (Global, 2017 vs. 2016) Source: Flurry Analytics State of Mobile 2017 (1/18). Note: n = 1MM applications across 2.6B devices globally. Sessions defined as when a user opens an app. 84

Product + Price Discovery = Often Video-Enabled… YouTube Taobao Many USA Consumers View YouTube 1.5MM+ Active Before Purchasing Products Content Creators Source: YouTube (3/16, 5/18), Alibaba (3/18), Right image: South China Morning Post (2/18). Note: Many USA customers refers to data in a report published by Google, based on Google / Ipsos Connect, 85 YouTubeSports Viewers Study conducted on n = 1,500 18-54 year old consumers in the USA in 3/16.

…Product + Price Discovery = Often Social + Gamified Wish Pinduoduo Hourly Deals Refer Friends to 300MM+ Users Reduce Price Source: Wish (5/18), Pinduoduo (1/18), Right image: Walkthechat (1/18). Note: Wish user figures are cumulative users, not MAU. 86

Physical Retail Trending = Long-Term Growth Deceleration 87

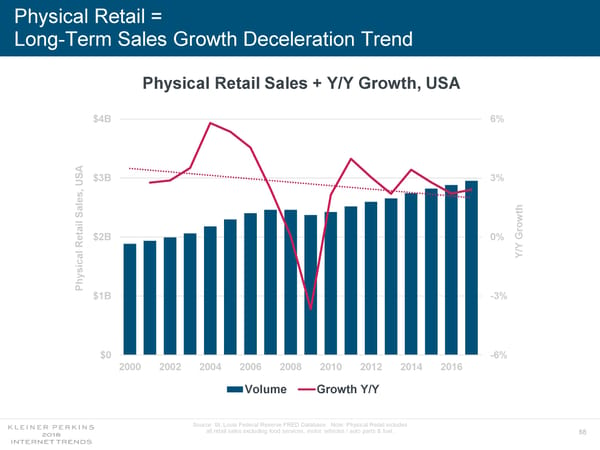

Physical Retail = Long-Term Sales Growth Deceleration Trend Physical Retail Sales + Y/Y Growth, USA $4B 6% $3B 3% USA , s le a th S il ow r $2B 0% G Reta /Y l a Y ic s hy P $1B -3% $0 -6% 2000 2002 2004 2006 2008 2010 2012 2014 2016 Volume Growth Y/Y Source: St. Louis Federal Reserve FRED Database. Note: Physical Retail includes all retail sales excluding food services, motor vehicles / auto parts & fuel. 88

‘New Retail’ = Alibaba View from China 89

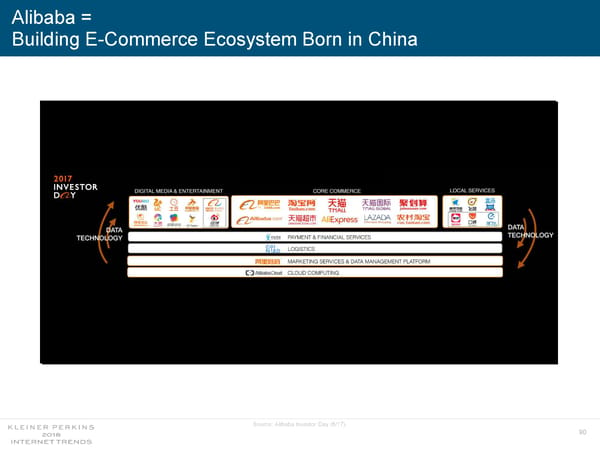

Alibaba = Building E-Commerce Ecosystem Born in China Source: Alibaba Investor Day (6/17). 90

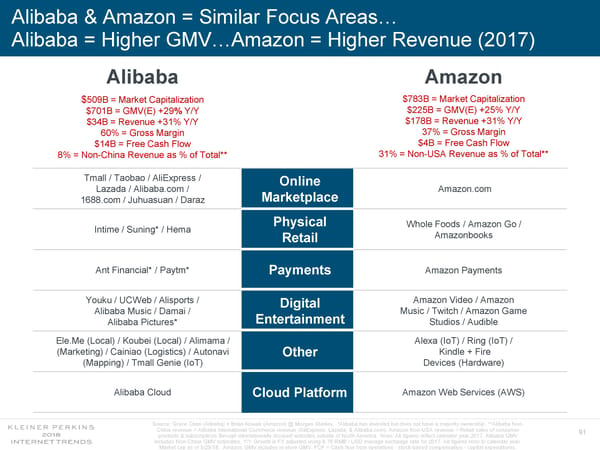

Alibaba & Amazon = Similar Focus Areas… Alibaba = Higher GMV…Amazon = Higher Revenue (2017) Alibaba Amazon $509B= Market Capitalization $783B = Market Capitalization $225B = GMV(E) +25% Y/Y $701B = GMV(E) +29%Y/Y $178B = Revenue +31% Y/Y $34B = Revenue +31% Y/Y 37% = Gross Margin 60% = Gross Margin $4B = Free Cash Flow $14B = Free Cash Flow 31% = Non-USA Revenue as % of Total** 8% = Non-China Revenue as % of Total** Tmall / Taobao / AliExpress / Online Lazada / Alibaba.com / Amazon.com Marketplace 1688.com / Juhuasuan / Daraz Physical Whole Foods / Amazon Go / Intime / Suning* / Hema Amazonbooks Retail Ant Financial* / Paytm* Amazon Payments Payments Youku / UCWeb / Alisports / Amazon Video / Amazon Digital Alibaba Music / Damai / Music / Twitch / Amazon Game Entertainment Alibaba Pictures* Studios / Audible Ele.Me (Local) / Koubei (Local) / Alimama / Alexa (IoT) / Ring (IoT) / (Marketing) / Cainiao (Logistics) / Autonavi Kindle + Fire Other (Mapping) / Tmall Genie (IoT) Devices (Hardware) Alibaba Cloud Amazon Web Services (AWS) Cloud Platform Source: Grace Chen (Alibaba) + Brian Nowak (Amazon) @ Morgan Stanley. *Alibaba has invested but does not have a majority ownership. **Alibaba Non- China revenue = Alibaba International Commerce revenue (AliExpress, Lazada, & Alibaba.com). Amazon Non-USA revenue = Retail sales of consumer 91 products & subscriptions through internationally-focused websites outside of North America. Note: All figures reflect calendar year 2017. Alibaba GMV includes Non-China GMV estimates, Y/Y Growth is FX adjusted using 6.76 RMB / USD average exchange rate for 2017. All figures refer to calendar year. Market cap as of 5/29/18. Amazon GMV includes in-store GMV. FCF = Cash flow from operations - stock-based compensation - capital expenditures.

Alibaba = ‘New Retail’ Vision Starts in China… …through technology & consumer insights, we [Alibaba] put the right products in front of right customers at the right time… our ‘New Retail’ initiatives are substantially growing Alibaba’s total addressable market in commerce… in this process of digitizing the entire retail operation, we are driving a massive transformation of the traditional retail industry. It is fair to say that our e-commerce platform is fast becoming the leading retail infrastructure of China. Since Jack Ma coined the term ‘New Retail’ in 2016, the term has been widely adopted in China by traditional retailers & Internet companies alike. New Retail has become the most talked about concept in business… Alibaba has three unique success factors that are enabling us to realize the New Retail vision. Alibaba CQ1:18 & CQ4:17 Earnings Calls, 5/4/18, 1/24/18 92

…Alibaba = ‘New Retail’ Vision Starts in China …Alibaba’s marketplace platforms handle billions of transactions each month in shopping, daily services & payments. These transactions provide us with the best insights into consumer behavior & shifting consumption trends. This puts us in the best position to enable our retail partners to grow their business. …Alibaba is a deep technology company. We contribute expertise in cloud, artificial intelligence, mobile transactions & enterprise systems to help our retail partners improve their businesses through digitization & operating efficiency. …Alibaba has the most comprehensive ecosystem of commerce platforms, logistics & payments to support the digital transformation of the retail sector. Alibaba CQ1:18 & CQ4:17 Earnings Calls, 5/4/18, 1/24/18. 93

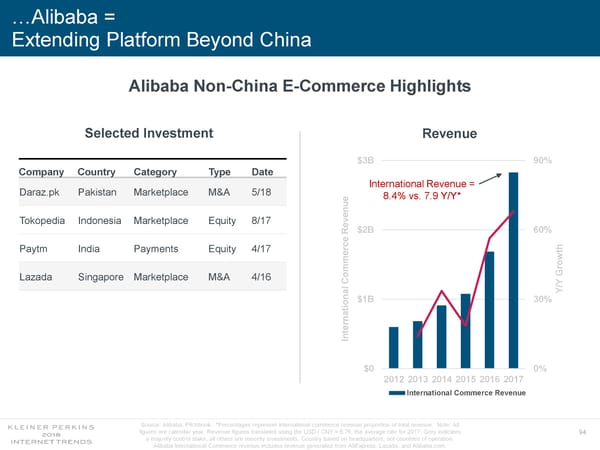

…Alibaba = Extending Platform Beyond China Alibaba Non-China E-Commerce Highlights Selected Investment Revenue $3B 90% Company Country Category Type Date International Revenue = Daraz.pk Pakistan Marketplace M&A 5/18 8.4% vs. 7.9 Y/Y* ue en Tokopedia Indonesia Marketplace Equity 8/17 ev R $2B 60% h Paytm India Payments Equity 4/17 t w ro ommerce G Lazada Singapore Marketplace M&A 4/16 C Y / al Y $1B 30% on nternati I $0 0% 2012 2013 2014 2015 2016 2017 International Commerce Revenue Source: Alibaba, Pitchbook. *Percentages represent international commerce revenue proportion of total revenue. Note: All figures are calendar year. Revenue figures translated using the USD / CNY = 6.76, the average rate for 2017. Grey indicates 94 a majority control stake, all others are minority investments. Country based on headquarters, not countries of operation. Alibaba International Commerce revenue includes revenue generated from AliExpress, Lazada, and Alibaba.com.

INTERNET ADVERTISING = GROWTH CONTINUING... ACCOUNTABILITY RISING 95

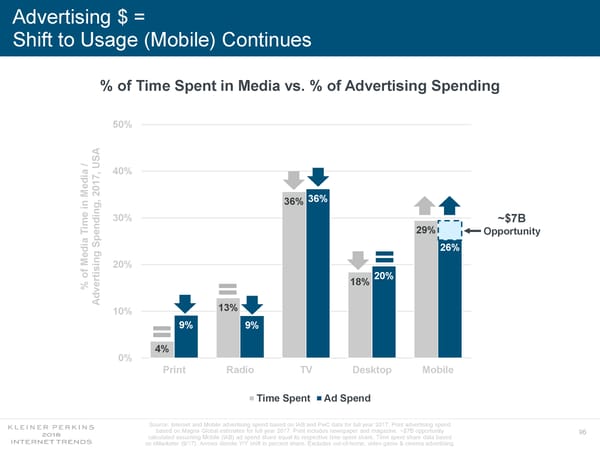

Advertising $ = Shift to Usage (Mobile) Continues % of Time Spent in Media vs. % of Advertising Spending 50% / USA , 40% 7 dia 1 0 2 36% 36% in Me 30% ~$7B imending, 29% T Opportunity pe S dia 26% ing Me 20% of 20% rtis 18% e % dv A 13% 10% 9% 9% 4% 0% Print Radio TV Desktop Mobile Time Spent Ad Spend Source: Internet and Mobile advertising spend based on IAB and PwC data for full year 2017. Print advertising spend based on Magna Global estimates for full year 2017. Print includes newspaper and magazine. ~$7B opportunity 96 calculated assuming Mobile (IAB) ad spend share equal its respective time spent share. Time spent share data based on eMarketer (9/17). Arrows denote Y/Y shift in percent share. Excludes out-of-home, video game & cinema advertising.

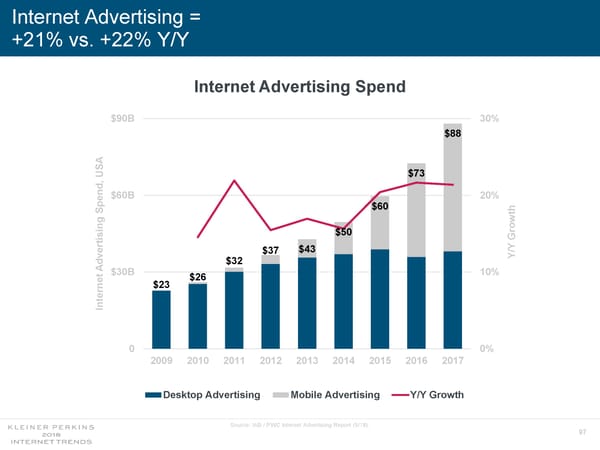

Internet Advertising = +21% vs. +22% Y/Y Internet Advertising Spend $90B 30% $88 USA $73 nd, $60B 20% pe $60 S th ing $50 Grow rtis e $43 /Y $37 Y dv $32 A $30B 10% t $26 ne $23 Inter 0 0% 2009 2010 2011 2012 2013 2014 2015 2016 2017 Desktop Advertising Mobile Advertising Y/Y Growth Source: IAB / PWC Internet Advertising Report (5/18). 97

Advertisers / Users vs. Content Platforms = Accountability Rising... Many Americans Believe Fake News Is Sowing Confusion Pew Research Center, December 2016 Adweek, July 2017 The Wall Street Journal, February 2018 98

...Advertisers / Users vs. Content Platforms = Accountability Rising Content Initiatives Google / YouTube Facebook (Q1:18) 8MM = Videos Removed (Q4:17)… 583MM = Fake Accounts Removed… 81% Flagged by Algorithms… 99% Flagged Prior To User Reporting 75% Removed Before First View 21MM = Pieces of Lewd Content Removed… 2MM= Videos De-Monetized For 96% Flagged by Algorithms Misleading Content Tagging (2017) 3.5MM = Pieces of Violent Content Removed… 10K = Content Moderators (2018 Goal) 86% Flagged by Algorithms 2.5MM = Pieces of Hate Speech Removed… 38% Flagged by Algorithms +7,500 = Content Moderators… 3,000 Hired (5/17–2/18) Source: YouTube (5/18, 12/17), Facebook (Transparency Report: 5/18, 5/17, 2/18). Note: All Google content moderators represent full-time 99 hires but Facebook content moderators are not all full-time.

CONSUMER SPENDING = DYNAMICS EVOLVING… INTERNET CREATING OPPORTUNITIES 100

Consumers… Making Ends Meet = Difficult 101

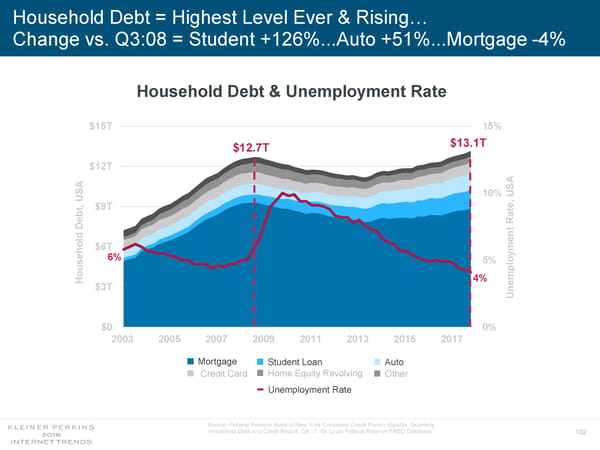

Household Debt = Highest Level Ever & Rising… Change vs. Q3:08 = Student +126%...Auto +51%...Mortgage -4% Household Debt & Unemployment Rate $15T 15% $13.1T $12.7T $12T A 10% USA , $9T Rate Debt, US nt $6T me hold e 6% 5% us mploy 4% Ho e $3T Un $0 0% 2003 2005 2007 2009 2011 2013 2015 2017 Mortgage Student Loan Auto Credit Card Home Equity Revolving Other Unemployment Rate Source: Federal Reserve Bank of New York Consumer Credit Panel / Equifax, Quarterly Household Debt and Credit Report, Q4:17; St. Louis Federal Reserve FRED Database. 102

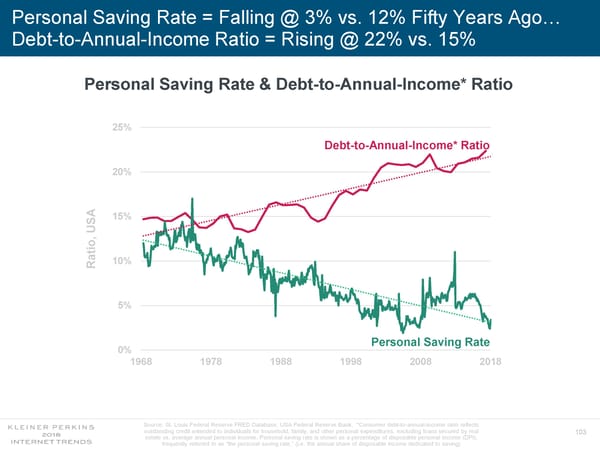

Personal Saving Rate = Falling @ 3% vs. 12% Fifty Years Ago… Debt-to-Annual-Income Ratio = Rising @ 22% vs. 15% Personal Saving Rate & Debt-to-Annual-Income* Ratio 25% Debt-to-Annual-Income* Ratio 20% 15% USA , o ati 10% R 5% Personal Saving Rate 0% 1968 1978 1988 1998 2008 2018 Source: St. Louis Federal Reserve FRED Database, USA Federal Reserve Bank. *Consumer debt-to-annual-income ratio reflects outstanding credit extended to individuals for household, family, and other personal expenditures, excluding loans secured by real 103 estate vs. average annual personal income. Personal saving rate is shown as a percentage of disposable personal income (DPI), frequently referred to as “the personal saving rate.” (i.e. the annual share of disposable income dedicated to saving)

Relative Household Spending = Shifting Over Past Half-Century 104

Relative Household Spending Rising Over Time = Shelter + Pensions / Insurance + Healthcare… Relative Household Spending 20% 17% 15% 15% SA U 12% , d 10% en 10% 8% Sp 7% 7% al u 5%5% n 5% n A 0% 1972 1990 2017 Total Expenditure $11K $31K $68K Source: USA Bureau of Labor Statistics (BLS), Consumer Expenditure Survey. *Pensions + Insurance includes deductions for private retirement accounts, social security, and life insurance. **Other Includes education and miscellaneous other expenses. Note: Results based on Surveys of American Urban & Rural Households 105 (Families & Single Consumers). 1972 data reflects non-annual survey conducted by BLS + Census Bureau to adjust CPI. 1990 and 2017 Data Based on Annual Survey performed by BLS + Census Bureau. Healthcare costs include insurance, drugs, out-of-pocket medical expenses, etc. 2017 = mid-year figures.

…Relative Household Spending Falling Over Time = Food + Entertainment + Apparel Relative Household Spending 20% 15% 15% 15% SA U , 12% d en 10% Sp 6% al u 5% 5% n 5% 4% 5% n A 3% 0% 1972 1990 2017 Total Expenditure $11K $31K $68K Source: USA Bureau of Labor Statistics (BLS), Consumer Expenditure Survey. *Pensions + Insurance includes deductions for private retirement accounts, social security, and life insurance. **Other Includes education and miscellaneous other expenses. Note: Results based on Surveys of American Urban & Rural Households 106 (Families & Single Consumers). 1972 data reflects non-annual survey conducted by BLS + Census Bureau to adjust CPI. 1990 and 2017 Data Based on Annual Survey performed by BLS + Census Bureau. Healthcare costs include insurance, drugs, out-of-pocket medical expenses, etc. 2017 = mid-year figures.

Food = 12% vs. 15% of Household Spending 28 Years Ago... 107

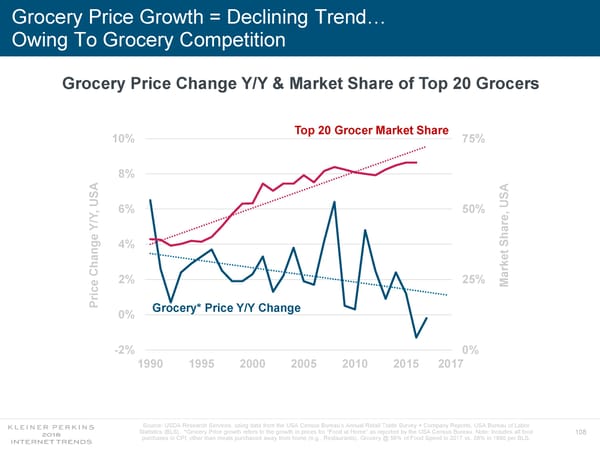

Grocery Price Growth = Declining Trend… Owing To Grocery Competition Grocery Price Change Y/Y & Market Share of Top 20 Grocers Top 20 Grocer Market Share 10% 75% 8% SA SA U U , 6% 50% Y e, Y/ ar e g Sh 4% t an h ke C ar 2% 25% M ce i Pr Grocery* Price Y/Y Change 0% -2% 0% 1990 1995 2000 2005 2010 2015 2017 Source: USDA Research Services, using data from the USA Census Bureau’s Annual Retail Trade Survey + Company Reports, USA Bureau of Labor Statistics (BLS). *Grocery Price growth refers to the growth in prices for “Food at Home” as reported by the USA Census Bureau. Note: Includes all food 108 purchases in CPI, other than meals purchased away from home (e.g., Restaurants). Grocery @ 56% of Food Spend in 2017 vs. 58% in 1990 per BLS.

Walmart = Helped Reduce Grocery Prices via Technology + Scale... per Greg Melich @ MoffettNathanson Walmart – Grocery Share 20% SA15% U e, ar 10% Sh y cer o 5% Gr 0% 1995 2000 2005 2010 2015 2017 By using technology to reduce inventory, expenses & shrinkage, we can create lower prices for our customers. - Walmart 1999 Annual Report Source: Greg Melich @ MoffettNathanson Note: Share reflects retail value of food for off-site 109 consumption sold across all Walmart properties.

E-Commerce = Helping Reduce Prices for Consumers 110

E-Commerce sales have risen rapidly over the past decade. Online prices are falling – absolutely & relative to – traditional inflation measures like the CPI. Inflation online is, literally, 200 basis points lower per year than what the CPI has been showing. To better understand the economy going forward, we will need to find better ways to measure prices & inflation. - Austan Goolsbee, Professor of Economics, University of Chicago Booth School of Business, 5/18 111

Consumer Goods Prices = Have Fallen… -3% Online & -1% Offline Over 2 1/4 Years per Adobe DPI… Consumer Prices For Matching Products - Online vs. Offline $1.02 A US Offline = -1% $1.00 ), 6 /1 /1 1 $0.98 d to e x e Online = -3% (Ind $0.96 s e ic r P $0.94 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2016 2017 2018 Online Retail (DPI) Offline Retail Source: Adobe Digital Economy Project Note: Adobe Digital Economy Project measures prices and sales volume for 80% of online transactions at top 100 USA retailers (15B site visits & 2.2MM products) then calculates a Digital Price Index (DPI) using a Fisher 112 Ideal model. CPI calculates USA prices using a basket of 83K goods, tracked monthly, & applied to a Laspeyeres model. DPI Excludes Apparel. Austan Goolsbee serves as strategic advisor to Adobe DPI project.

…Online vs. Offline Price Decline Leaders = TVs / Furniture / Computers / Sporting Goods per Adobe DPI Price Change, Y/Y (DPI vs. CPI), USA, 3/17-3/18 10% 0% (10%) (20%) DPI vs. CPI 5% 1% 1% 0% 0% 0% 0% -1% -1% -1% -2% -2% -3% -4% Difference (%) (30%) DPI CPI Source: Adobe Digital Economy Project Note: Adobe Digital Economy Project measures prices and sales volume for 80% of online transactions at top 100 USA retailers (15B site visits & 2.2MM products) then calculates a Digital Price Index (DPI) using a Fisher 113 Ideal model. CPI calculates USA prices using a basket of 83K goods, tracked monthly, & applied to a Laspeyeres model. DPI Excludes Apparel. Austan Goolsbee serves as strategic advisor to Adobe DPI project.

We've seen how technology can make online shopping more efficient, with lower prices, more selection & increased convenience. We are about to see the same thing happen to offline shopping. - Hal Varian, Chief Economist @ Google, 5/18 114

Relative Household Spending = How Might it Evolve? Shelter Spend = Rising Transportation Spend = Flat Healthcare Spend = Rising 115

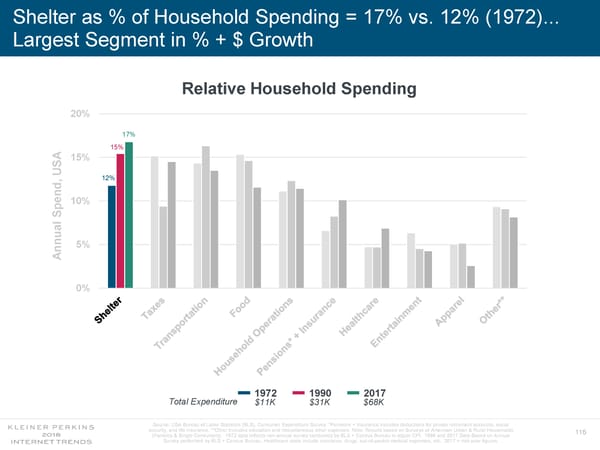

Shelter as % of Household Spending = 17% vs. 12% (1972)... Largest Segment in % + $ Growth Relative Household Spending 20% 17% 15% 15% SA U 12% , d en 10% Sp al u n 5% n A 0% 1972 1990 2017 Total Expenditure $11K $31K $68K Source: USA Bureau of Labor Statistics (BLS), Consumer Expenditure Survey. *Pensions + Insurance includes deductions for private retirement accounts, social security, and life insurance. **Other Includes education and miscellaneous other expenses. Note: Results based on Surveys of American Urban & Rural Households 116 (Families & Single Consumers). 1972 data reflects non-annual survey conducted by BLS + Census Bureau to adjust CPI. 1990 and 2017 Data Based on Annual Survey performed by BLS + Census Bureau. Healthcare costs include insurance, drugs, out-of-pocket medical expenses, etc.. 2017 = mid-year figures.

Shelter… 117

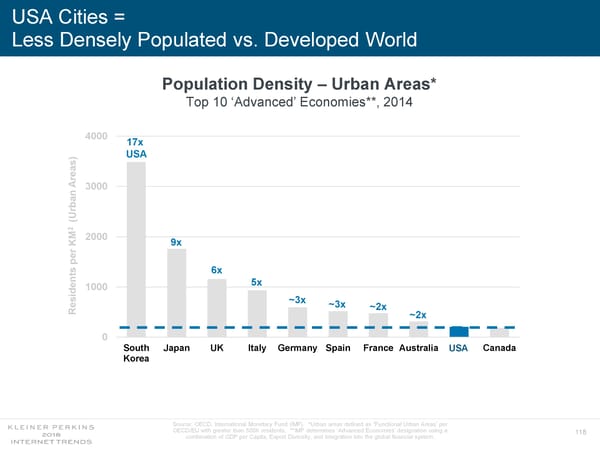

USA Cities = Less Densely Populated vs. Developed World Population Density – Urban Areas* Top 10 ‘Advanced’ Economies**, 2014 4000 17x USA ) s a re A 3000 n rba (U 2 2000 9x r KM pe s 6x nt 5x 1000 ide ~3x ~3x ~2x Res ~2x 0 South Japan UK Italy Germany Spain France Australia USA Canada USA Korea Source: OECD, International Monetary Fund (IMF). *Urban areas defined as “Functional Urban Areas’ per OECD/EU with greater than 500K residents. **IMF determines ‘Advanced Economies’ designation using a 118 combination of GDP per Capita, Export Diversity, and integration into the global financial system.

USA Homes = Bigger vs. Developed World… Average Home Size* (Square Feet) – Select Countries USA Japan ~1,500 ~1,015 UK ~990 South Korea ~725 Source: Wikimedia, Japan Ministry of Internal Affairs, US Census Bureau, UK Office for National Statistics, Asian Development Bank Institute. *USA + Japan + UK = 2013. Korea = 2010, owing to lag in publication of government measured data. Note: Data reflects average occupied dwelling size across each nation. 119

…USA Homes = Getting Bigger...Residents Falling @ 2.5 vs. 3.0 (1972) Average New Home Square Footage & Residents 4K 4 SA U e, SA Residents U 3K 3 tag per Home o o me, F o e H ar u 2K er 2 p Sq ts New Home me en o d Square Footage H 1K 1 esi R ew N 0 0 1972 1976 1980 1984 1988 1992 1996 2000 2004 2008 2012 2016 Source: USA Census Bureau (6/17). Note: Data reflects newly built housing stock. Single Family homes includes newly built single family homes. Similar growth trends are seen across all housing units, as single-family homes are the majority of new USA housing stock. Average size of multifamily new 120 dwelling in USA = 1,095 square feet in 1999 (earliest data available), 1,207 square feet in 2016. Residents per household based on all households.

USA Office Space = Steadily Getting Denser / More Efficient Occupied Office Space per Employee – Square Feet 250 SA 195 U 200 180 ee, y o l 150 Emp r e p e 100 tag o o F e ar 50 u Sq 0 1990 1995 2000 2005 2010 2015 2017 Source: CoStart Portfolio strategy Analysis of USA Leased office space & USA Employment Figures (2017). 121

…Shelter... To Contain Spending… Consumers May Aim to Increase Utility of Space 122

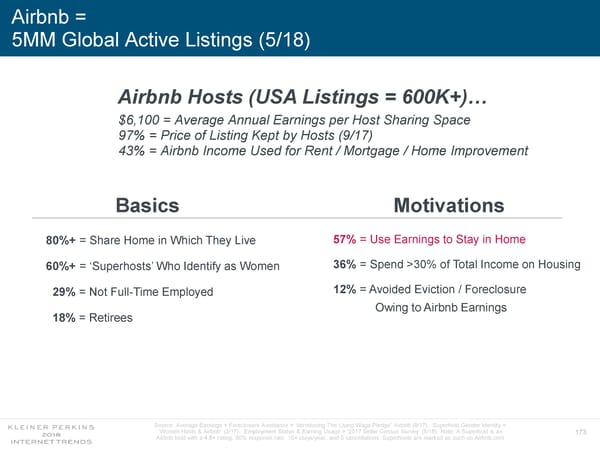

Airbnb = Provides Income Opportunities for Hosts… Airbnb Guest Arrivals & Active Listings by Hosts 5MM Global Active Listings 90MM 6MM obal 60MM 4MM obal Gl , Gl ls a v rri tings, A t Lis s e 30MM 2MM tiv Gue c A 0 0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Guest Arrivals Active Listings by Hosts Source: Airbnb, TechCrunch. Note: Airbnb disclosed in 2017 ~660K listings were in USA. A 2017 CBRE study of ~256K USA Airbnb listings + ~177K Airbnb hosts in Austin, Boston, Chicago, LA, Miami, Nashville, New Orleans, New York City, Oahu, 123 Portland, San Francisco, Seattle, & Washington D.C. found that 83% of listings are made by single-listing hosts, or are listings for spaces within otherwise occupied dwellings. This implies that there >500K individuals listing spaces on Airbnb in USA as of 2018.

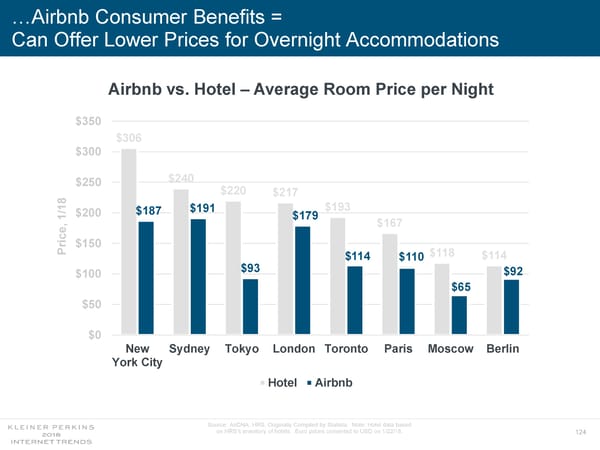

…Airbnb Consumer Benefits = Can Offer Lower Prices for Overnight Accommodations Airbnb vs. Hotel –Average Room Price per Night $350 $306 $300 $240 $250 $220 $217 18 $193 $191 $187 $200 1/ $179 $167 ce, i $150 Pr $118 $114 $114 $110 $93 $92 $100 $65 $50 $0 New Sydney Tokyo London Toronto Paris Moscow Berlin York City Hotel Airbnb Source: AirDNA, HRS, Originally Compiled by Statista. Note: Hotel data based on HRS’s inventory of hotels. Euro prices converted to USD on 1/22/18. 124

Relative Household Spending = How Might it Evolve? Shelter Spend = Rising Transportation Spend = Flat Healthcare Spend = Rising 125

Transportation as % of Household Spending = 14% vs. 14% (1972)... #3 Segment of $ Spending Behind Shelter + Taxes Relative Household Spending 20% 16% 14% 15% 14% SA U , d en 10% Sp al u n 5% n A 0% 1972 1990 2017 Total Expenditure $11K $31K $68K Source: USA Bureau of Labor Statistics (BLS), Consumer Expenditure Survey. *Pensions + Insurance includes deductions for private retirement accounts, social security, and life insurance. **Other Includes education and miscellaneous other expenses. Note: Results based on Surveys of American Urban & Rural Households 126 (Families & Single Consumers). 1972 data reflects non-annual survey conducted by BLS + Census Bureau to adjust CPI. 1990 and 2017 Data Based on Annual Survey performed by BLS + Census Bureau. Healthcare costs include insurance, drugs, out-of-pocket medical expenses, etc.. 2017 = mid-year figures.

Transportation… To Contain Spending… Consumers Reducing Relative Spend on Vehicles + Increasing Utility of Vehicles 127

Transportation as % of Household Spending = Vehicle Purchase % Declining…Other Transportation % Rising Relative Household Spending – Transportation 60% Relative Transportation Spending = SA U , d en Vehicles Stay On Road Longer... Sp 40% @ 12 vs. 8 Years (1995) n o Average Car Lifespan tati r o sp 20% …Other Transportation Rising an r T +30% vs. 1995 e v Public Transit Usage ati 0% el R ~2x Y/Y (2017) 1972 1990 2017 Ride-Share Rides Vehicle Operation + Vehicle Purchases Maintenance* Other Gas + Oil Transportation Source: USA BLS Consumer Expenditure Survey. Vehicle Age = Bureau of Transportation Statistics + I.H.S. Public Transit Trips = American Public Transit Association Note: *Vehicle Operation + Maintenance includes Insurance, Repairs, Parking, and Other expenses. Other transportation includes all transportation outside of personal vehicles, including rise-sharing.. 128 Results based on Surveys of American Urban and Rural Households (Families and Single Consumers). 1972 data reflects non-annual survey conducted by BLS + Census Bureau to adjust CPI. 1990 and 2017 Data Based on Annual Survey performed by BLS + Census Bureau. Cars refers to all light vehicles (i.e. passenger cars + light trucks). Includes all actively driven cars. Public transit trips reflect unlinked rides (i.e. one full journey). Note: Ride Share Statistics based on Q1:16 and Q1:17 Estimates from Hillhouse Capital.

Uber = Can Provide Work Opportunities for Driver-Partners… Uber Gross Bookings & Driver-Partners 3MM Global Driver-Partners +50*% $45B 3MM $30B 2MM obal obal Gl Gl , , ings rtners a ok P - r $15B 1MM Bo e s Driv Gros $0 0 2012 2013 2014 2015 2016 2017 Gross Bookings Driver-Partners Source: Uber. *Approximately +50% Y/Y. Note: ~900K USA Driver-Partners. Note: As of Jan 2015, ~85% of Uber driver-partners drove for UberX – based on historical growth rates, it is estimated that >90% of USA Uber driver-partners drive for UberX. 129

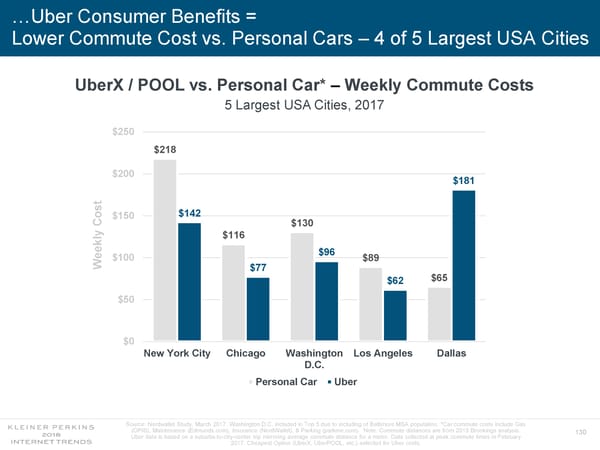

…Uber Consumer Benefits = Lower Commute Cost vs. Personal Cars – 4 of 5 Largest USA Cities UberX / POOL vs. Personal Car* – Weekly Commute Costs 5 Largest USA Cities, 2017 $250 $218 $200 $181 st o $142 $150 C $130 $116 $96 eekly $100 $89 W $77 $65 $62 $50 $0 New York City Chicago Washington Los Angeles Dallas D.C. Personal Car Uber Source: Nerdwallet Study, March 2017. Washington D.C. included in Top 5 due to including of Baltimore MSA population. *Car commute costs include Gas (OPIS), Maintenance (Edmunds.com), Insurance (NerdWallet), & Parking (parkme.com). Note: Commute distances are from 2015 Brookings analysis. 130 Uber data is based on a suburbs-to-city-center trip mirroring average commute distance for a metro. Data collected at peak commute times in February 2017. Cheapest Option (UberX, UberPOOL, etc.) selected for Uber costs.

Relative Household Spending = How Might it Evolve? Shelter Spend = Rising Transportation Spend = Flat Healthcare Spend = Rising CREATED BY NOAH KNAUF @ KLEINER PERKINS 131

Healthcare as % of Household Spending = 7% vs. 5% (1972)... Fastest Relative % Grower Relative Household Spending 20% 15% SA U , d en 10% Sp 7% al u 5% 5% n 5% n A 0% 1972 1990 2017 Total Expenditure $11K $31K $68K Source: USA Bureau of Labor Statistics (BLS), Consumer Expenditure Survey. *Pensions + Insurance includes deductions for private retirement accounts, social security, and life insurance. **Other Includes education and miscellaneous other expenses. Note: Results based on Surveys of American Urban & Rural Households 132 (Families & Single Consumers). 1972 data reflects non-annual survey conducted by BLS + Census Bureau to adjust CPI. 1990 and 2017 Data Based on Annual Survey performed by BLS + Census Bureau. Healthcare costs include insurance, drugs, out-of-pocket medical expenses, etc.. 2017 = mid-year figures.

Healthcare Spending = Increasingly Shifting to Consumers… 133

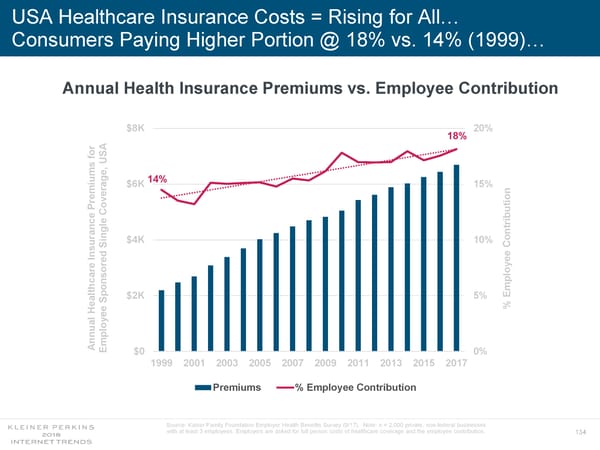

USA Healthcare Insurance Costs = Rising for All… Consumers Paying Higher Portion @ 18% vs. 14% (1999)… Annual Health Insurance Premiums vs. Employee Contribution $8K 20% 18% r SA fo U , 14% age $6K 15% miums er re ov P C e le ribution nc nt ng $4K 10% ura Si Co d e Ins e re sore mploy lthca E $2K 5% Spon % Hea ee nnual A Employ $0 0% 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 Premiums % Employee Contribution Source: Kaiser Family Foundation Employer Health Benefits Survey (9/17). Note: n = 2,000 private, non-federal businesses with at least 3 employees. Employers are asked for full person costs of healthcare coverage and the employee contribution. 134

…USA Healthcare Deductible Costs = Rising A Lot… Employees @ >$2K Deductible = 22% vs. 7% (2009) Annual Deductibles vs. % of Covered Employees with >$2K Deductibles $1,500 30% ith e w ble s 22% cti ee a Singl loy in Dedu $1,000 20% Emp, USA 2K ge >$ ng era ith mo A s Enrolledw Cov n ee ble le $500 7% 10% Pla cti ge Sing Dedu era l of Employ ua % Cov nn A $0 0% 2006 2008 2010 2012 2014 2016 Annual Deductible Among Covered Employees % of Employees Enrolled in a Plan with >$2K Deductible Source: Kaiser Family Foundation Employer Health Benefits Survey (9/17). Note: n = 2,000 private, non-federal businesses with at least 3 employees. Employers are asked for full person costs of healthcare coverage and the employee contribution. 135

When Consumers Start Spending More They Tend To Pay More Attention to Value + Prices… Will Market Forces Finally Come to Healthcare & Drive Prices Lower for Consumers? 136

Healthcare Patients Increasingly Developing Consumer Expectations… Modern Retail Experience Digital Engagement On-Demand Access Vertical Expertise Transparent Pricing Simple Payments 137

Healthcare Consumerization… Modern Retail Digital Healthcare On-Demand Experience Management Pharmacy One Medical Oscar Capsule Office Locations Memberships Unique Conversations 300K 30K 80 s s s ship ion e t ice er 150K 15K f40 sa f iqu O er emb Unv n M 0 0 0 Co 2014 2016 2018 2014 2015 2017 2016 2017 Source: One Medical, Web.Archive.org, Oscar, Capsule. Note: Oscar data as of the first month of each year based on enrollments timing. 138

…Healthcare Consumerization Women’s Healthcare Transparent Simplified Specific Solutions Pricing Healthcare Billing Nurx Dr. Consulta Cedar Medical Interactions* Patients % of Collections** 100K 1,000K 100% s s n s ion t nt ctio 50K ie500K ac 50% t lle er a P Co Int f o 0 0 0% % 2016 2017 2018 2013 2015 2017 0 31 60 91 Days Source: Nurx, Dr. Consulta, Cedar. *Medical interactions include prescriptions, lab orders, & messages from MDs / RNs. **Cedar data represents the % of total collections using Cedar 139 over time at a multispecialty group with 450 physicians and an ambulatory surgical center.

Consumerization of Healthcare + Rising Data Availability = On Cusp of Reducing Consumer Healthcare Spending? 140

WORK = CHANGING RAPIDLY… INTERNET HELPING, SO FAR… 141

Technology Disruption = Not New...But Accelerating 142

Technology Disruption = Not New… New Technology Proliferation Curves* 100% 75% USA n, 50% io dopt A 25% 0% 1900 1915 1930 1945 1960 1975 1990 2005 2017 Grid Electricity Radio Refrigerator Automatic Transmission Color TV Shipping Containers Microwave Computer Cell Phone Internet Social Media Usage Smartphone Usage Source: ‘Our World In Data’ collection of published economics data including Isard (1942), Grubler (1990), Pew Research, USA Census Bureau, and others. *Proliferation defined by share of households using a particular technology. In the case 143 of features (e.g., Automatic Transmission), adoption refers to share of feature in available models.

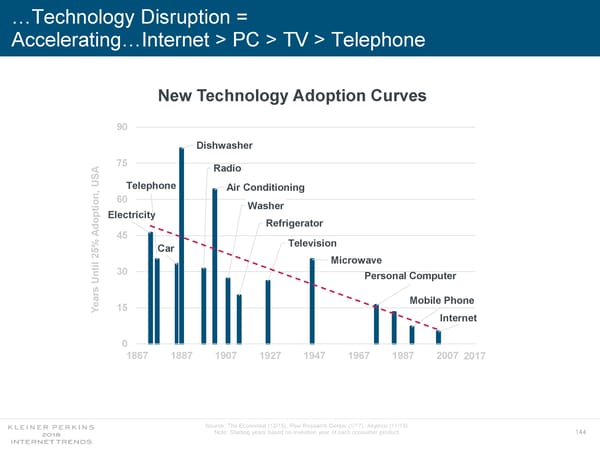

…Technology Disruption = Accelerating…Internet > PC > TV > Telephone New Technology Adoption Curves 90 Dishwasher 75 Radio USA Telephone Air Conditioning 60 ion, Washer Electricity Refrigerator dopt A 45 % Television 5 Car Microwave til 2 30 Personal Computer Un rs a Mobile Phone e 15 Y Internet 0 1867 1887 1907 1927 1947 1967 1987 2007 2017 Source: The Economist (12/15), Pew Research Center (1/17), Asymco (11/13). Note: Starting years based on invention year of each consumer product. 144

Technology Disruption Drivers = Rising & Cheaper Compute Power + Storage Capacity... Storage Price vs. Hard Drive Capacity $1,000 of Computer Equipment 10000GB $10,000,000 1.E+10 1.E+09 Pentium II PC $1,000,000 1.E+08 1000GB 1.E+07 ity $100,000 c 1.E+06 Sun 1 100GB 1.E+05 ond $10,000 c Capa e 1.E+04 S ge 10GB r 1.E+03 $1,000 ra BINAC pe 1.E+02 to per GB IBM 1130 S 1.E+01 $100 e ce 1GB tions 1.E+00 Pri Driv ula1.E-01 $10 c 0.1GB 0GB 1.E-02 Cal Hard $1 1.E-03 IBM Tabulator 1.E-04 0.01GB 0GB $0 $0.1 1.E-05 Analytical Engine 1.E-06 0.001GB 0GB $0 $0.01 1.E-07 1956 1987 2017 1900 1925 1950 1975 2000 2025 Price Per GB Capacity Source: John McCallum @ IDC, David Rosenthal @ LOCKSS Program – Stanford): Kryder’s Law. Time + Ray Kurzweil analysis of multiple sources, including Gwennap (1996), Kempt (1961) and others. Note: All figures shown on logarithmic scale. 145

...Technology Disruption Drivers = Rising & Cheaper Connectivity + Data Sharing Internet + Social Media – Global Penetration 60% 49% 50% 40% obal 33% Gl 30% 24% tration, ne e 20% P 14% 10% 0% 2009 2010 2011 2012 2013 2014 2015 2016 2017 Internet Social Media Source: United Nations / International Telecommunications Union, USA Census Bureau. Internet user data is as of mid-year Internet user data: Pew Research (USA), China Internet Network Information Center (China), Islamic Republic News Agency / InternetWorldStats / KP estimates (Iran), KP 146 estimates based on IAMAI data (India), & APJII (Indonesia). Population sourced from Central Intelligence Agency database. eMarketer estimates for Social Media users based on number of active accounts, not unique users. Penetration calculated as a % of total population based on the CIA database.

New Technologies = Created / Displaced Jobs Historically 147

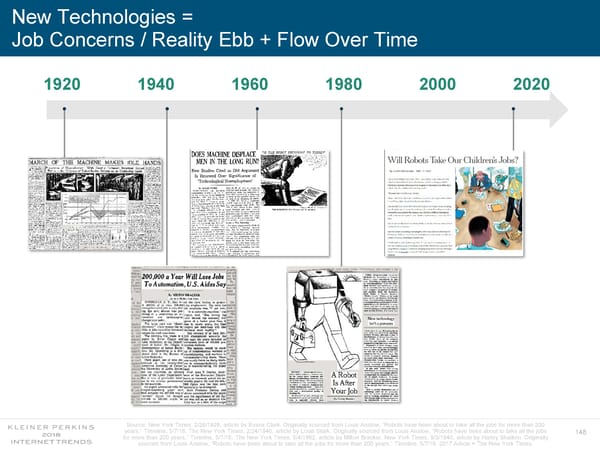

New Technologies = Job Concerns / Reality Ebb + Flow Over Time 1920 1940 1960 1980 2000 2020 Source: New York Times, 2/26/1928, article by Evans Clark. Originally sourced from Louis Anslow, “Robots have been about to take all the jobs for more than 200 years,” Timeline, 5/7/16. The New York Times, 2/24/1940, article by Louis Stark. Originally sourced from Louis Anslow, “Robots have been about to take all the jobs 148 for more than 200 years,” Timeline, 5/7/16. The New York Times, 5/4/1962, article by Milton Bracker. New York Times, 9/3/1940, article by Harley Shaiken. Originally sourced from Louis Anslow, “Robots have been about to take all the jobs for more than 200 years,” Timeline, 5/7/16. 2017 Article = The New York Times.

New Technologies = Aircraft Jobs Replaced Locomotive Jobs... Locomotive vs. Aircraft Jobs 400K 300K A US 200K obs, J 100K 0 1950 1960 1970 1980 1990 2000 2010 2015 Locomotive Jobs - Engineers / Operators / Conductors Aircraft Jobs - Pilots / Mechanics / Engineers Source: ITIF analysis of IPUMS data (Atkinson + Wu); St. Louis Federal Reserve FRED Database. Note: IPUMS data tracks historical employment (since 1950) using 2010 Census occupational codes. (7140:Aircraft Mechanics + Service Technicians; 9030: Aircraft Pilots + Flight Engineers; 9200: 149 Locomotive Engineers + Operators; 9230: Railroad Brake, Signal, + Switch Operators; 9240: Railroad Conductors + Yardmasters).

…New Technologies = Services Jobs Replaced Agriculture Jobs … Agriculture vs. Services Jobs 25MM 20MM 15MM USA obs, 10MM J 5MM 0 1900 1910 1920 1930 Agriculture Jobs - Farming / Forestry / Fishing / Hunting Services Jobs - Business / Education / Healthcare / Retail / Government / Other Services Source: Growth & Structural Transformation – Herrendorf et al. (NBER, 2013) Services includes all non-farm jobs except goods-producing industries such as natural resources / mining, construction and manufacturing. 150

…Agriculture = <2% vs. 41% of Jobs in 1900 Agriculture vs. Services Jobs 150MM 120MM 90MM SA U 60MM Jobs, 1900 Agriculture = 41% of Jobs 30MM 2017 Agriculture = <2% of Jobs 0 1900 1915 1930 1945 1960 1975 1990 2005 2017 Agriculture Jobs - Farming / Forestry / Fishing / Hunting Services Jobs - Business / Education / Healthcare / Retail / Government / Other Services Source: St. Louis Federal Reserve FRED Database, Growth & Structural Transformation – Herrendorf et al. (NBER, 2013), Bureau of Labor Statistics Note: Pre-1948 Agriculture data = Herrendorf et al. Post 1948 = Bureau of Labor Statistics. Pre-1939 151 services data = Herrendorf et al. Post 1939 services data = Bureau of Labor Statistics. Services includes all non-farm jobs except excluding Goods-Producing industries such as Natural Resources / Mining, Construction and Manufacturing.

70 Years = New Technology Concerns Ebb / Flow... GDP Rises...Unemployment Ranges 2.9 - 9.7% Real GDP vs. Unemployment Rate, USA $18T 30% $12T 20% Rate DP nt G l me y Rea plo 5.8% $6T 10% 70-Year Average Unem 3.9% Unemployment Rate (4/18) $0 0% 1929 1939 1949 1959 1969 1979 1989 1999 2009 2017 Real GDP Unemployment Rate Source: St. Louis Federal Reserve FRED Database, Bureau of Economic Analysis, BLS. Note: Real GDP based on chained 2009 dollars. Unemployment rate = annual average. 152

Will Technology Impact Jobs Differently This Time? Perhaps...But It Would Be Inconsistent With History as... New Jobs / Services + Efficiencies + Growth Typically Created Around New Technologies 153

Job Market = Solid Based on Traditional High-Level Metrics, USA 154

Unemployment @ 3.9% = Well Below 5.8% Seventy Year Average Unemployment Rate 30% 20% SA U ate, R ment y 10% nemplo U Average = 5.8% 0% 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 2018 Source: St Louis Federal Reserve FRED Database, Bureau of the Budget (1957). Note: Unemployment rate calculated by diving the total workforce by the total number of unemployed people. People are classified as unemployed if they do 155 not have a job, have actively looked for work in the prior 4 weeks and are currently available for work.

Consumer Confidence = High & Rising… Index @ 100 vs. 87 Fifty-Five Year Average Consumer Confidence Index (CCI) 120 100 USA ), 80 87= 4 6 9 55-Year Average 1 to 60 d e 40 (Index I CC 20 0 1952 1957 1962 1967 1972 1977 1982 1987 1992 1997 2002 2007 2012 2017 Source: St. Louis Federal Reserve FRED Database. Note: Indexed to Q1:66 = 100. Consumer Confidence Index (Michigan Consumer Sentiment Index) is a broad measure of American consumer sentiment, as 156 measured through a 50-question telephone survey of at least 500 USA residents each month.

Job Openings = 17 Year High… @ 7MM…~3x Higher vs. 2009 Trough Job Openings* – USA 7MM 6.6MM Job Openings (3/18) 6MM 1.4MM = Professional Services + Finance 5MM 1.3MM = Healthcare + Education * 1.2MM = Trade / Transportation / Utilities 4MM nings 879K = Leisure / Hospitality 3MM ob Ope J 661K = Mining / Construction / Manufacturing 2MM 622K = Government 1MM 486K = Other 0 2000 2005 2010 2015 2018 Source: St Louis Federal Reserve FRED Database. *A job opening is defined as a non-farm specific position of employment to be filled at an establishment. Conditions include the following: there is work available for 157 that position, the job could start within 30 days, and the employer is actively recruiting for the position.

Job Growth = Stronger in Urban Areas Where 86% of Americans Live Job / Population Growth – Urban vs. Rural (Indexed to 2001) 120 Jobs = +19% Population = +15% 110 Jobs = +4% Population = +4% 100 90 2001 2006 2011 2016 Urban Rural Source: USDA ERS, BLS. Note: LAUS county-level data from BLS are aggregated into urban (metropolitan/metro) and rural (nonmetropolitan / non-metro), based on the Office of Management and Budget's 2013 metropolitan classification. Metro areas 158 defined as counties with urban areas >50K in population and the outlying counties where >35% of population commutes to an urban center for work. ’Rural’ data reflects total non-metro employment, where population has been declining since 2011.

Labor Force Participation @ 63% = Below 64% Fifty-Year Average...~3.5MM People Below Average* Labor Force Participation Rate** 90% 80% 70% USA , 60% 64% = Rate 50 Year Average tion 50% ipa rtic 40% a P e 30% bor Forc20% La 10% 0% 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 Source: St Louis Federal Reserve FRED Database, BLS. *In March 2018, ~161.8MM Americans were in the labor force (62.9% participation). Participation @ 50-year average of 64.3% would imply a labor force of 165.3MM. The labor force participation rate is defined as the section of working population in the age group of 16+ in the 159 economy currently employed or seeking employment. **For data from 1900-1945 the labor force participation rate includes working population over the age of 10.

Most Common Activities For Many Who Don’t Work* = Leisure / Household Activities / Education Males* (Ages 25-54) – Daily Time Use Not In Labor Force In Labor Force Watching TV +3 Hours Watching TV Other Socializing, Relaxing, Leisure Other Socializing, Relaxing, Leisure +0.7 Other (Including Sleep) +0.6 Other (Including Sleep) Household Activities & Services Household Activities & Services +0.5 Education +0.3 Education +0.01 Caring for Non-Household Members Caring For Non-Household Members Caring for Household Members -0.02 -5 Work 0 2 4 6 8 10 12 14 Hours per Day, USA, 6/16 Source: 2014 American Time Use Survey, CEA calculations, BLS. Note: Prime-age males defined as men between the ages of 25-54. Daily hours may not add up to 24 since some individuals do not report all time spent. 160 Household activities include cleaning, cooking, yardwork & home maintenance not related to caregiving.

Job Expectations = Evolving 161

Most Desired Non-Monetary Benefit for Workers = Flexibility per Gallup Would You Change Jobs to Have Access To… 75% 61% 54% 53% 51% 51% 48% ) 50% 7 1 0 40% (2 A 35% US , re ha25% S 0% Health Monetary Paid Flexible Pension Paid Profit Working Insurance Bonuses Vacation Schedule Leave Sharing From Home Source: Gallup 2017 State of the American Workplace Note: *Flexible schedule defined as ability to choose own hours of work. Gallup developed State of the American Workplace using data collected from more than 195,600 USA employees via the Gallup Panel and Gallup Daily tracking in 2015 162 and 2016, and more than 31 million respondents through Gallup's Q12 Client Database. First launched in 2010, this is the third iteration of the report.

Technology = Makes Freelance Work Easier to Find… Freelance Workforce = 3x Faster Growth vs. Total Workforce Has Technology Has Made It Workforce Growth – Easier To Find Freelance Work? Freelance vs. Total 100% 110% USA , 108% +8.1% ly USA e th, itiv os 77% 106% ow r P G 75% e ing rc 104% fo 69% pond ork +2.5% W Res 102% % 50% 100% 2014 2015 2016 2017 2014 2015 2016 2017 Total Freelance Source: ‘Freelancing in America: 2017’ survey conducted by Edelman Research, co-commissioned by Upwork and Freelancers Union. Note: Survey conducted 7/17-8/17, n = 2,173 Freelance Employees who 163 have received payment for supplemental temporary, or project-oriented work in the past 12 months.

On-Demand Jobs = Big Numbers + High Growth Increasingly Filling Needs for Workers Who Want Extra Income / Flexibility... Have Underutilized Skills / Assets 164

On-Demand Workers = 5.4MM +23%, USA per Intuit On-Demand Platform Workers, USA 8MM 6.8* 6MM 5.4 SA U 3.9 s, 4MM ker r o 2.4 W 2MM 0 2015 2016 2017 2018E Source: Intuit (2017/2018). *2018 = Forecast from 2017 data. Preliminary 2018 results appear to be in line with forecast as of 5/16/18. Note: On-demand workers defined as online marketplace workers including transportation and/or logistics for people or products, online 165 talent marketplaces, renting out space. Providing other miscellaneous consumer and business services (e.g. TaskRabbit, Gigwalk, Wonolo, etc.). Workers defined as ‘active’ employees that have done ’significant’ on-demand work within the preceding 6 months.

On-Demand Jobs = >15MM Applicants on Checkr Platform Since 2014, USA Checkr Background Check On-Demand Applicants – Top 100 Metro Areas, USA Source: Checkr (2018) 166

On-Demand Jobs = Big Numbers + High Growth Real-Time Internet-Enabled Platforms Marketplaces Uber @ 3MM Driver-Partners Etsy @ 2MM Sellers $45B 3MM $4B 2MM s e l a obal obal S e $3B Gl Gl s , $30B 2MM s obal obal ngs, Gl Gl ner handi, , )$2B 1MM rt a rcS rs ooki P e e Airbnb @ 5MM Listings l B - l $15B 1MM r M GM e e ( s S v s $1B 90MM 6MM ri l D Gros Gros obal oba l $0 0 $0 0 Gl G , , 2014 2015 2016 2017 2014 2015 2016 2017 s l60MM 4MM a ngs Gross Bookings Driver-Partners GMS Sellers v i t rri s A Li t s e 30MM 2MM v DoorDash @ 200K Dashers i Upwork @ 16MM Freelancers t c Gue A 250K 20MM 0 0 obal200K 2014 2015 2016 2017 2018 obal Gl 15MM , Gl Guest Arrivals Active Listings s , 150K rs her s 10MM a nce 100K a D l e Fre5MM 50K 0K 0 2014 2015 2016 2017 2014 2015 2016 2017 Lifetime Dashers Freelancers Uber Source: Uber Note: ~900K USA Uber Driver-Partners. As of 1/15, based on historical growth rates, it is estimated that >90% of USA Uber driver-partners drive for UberX. DoorDash Source: DoorDash. Note: Lifetime Dashers defined as the total number of people that have dashed on the platform, most of which are still active. Etsy Source: Etsy. Note: In 167 2017, 65% of Etsy Sellers were USA-based (1.2MM). Upwork Source: Upwork. Airbnb Source: Airbnb, Note: Airbnb disclosed in 2017 that ~660K of their listings were in USA. A 2017 CBRE study of ~256K USA Airbnb listings + ~177K Airbnb hosts in Austin, Boston, Chicago, LA, Miami, Nashville, New Orleans, New York City, Oahu, Portland, San Francisco, Seattle, & Washington D.C. found 83% of hosts are single-listing hosts / non-full-home hosts. This implies >500K USA hosts.

On-Demand Jobs = Big Numbers + High Growth Filling Needs for Workers Who Want Extra Income / Flexibility... Have Underutilized Skills / Assets 168

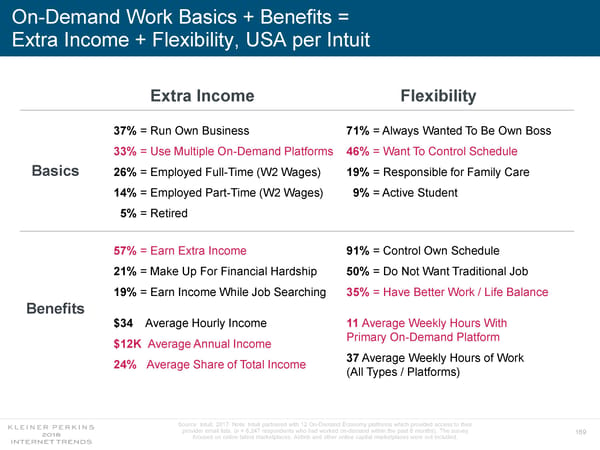

On-Demand Work Basics + Benefits = Extra Income + Flexibility, USA per Intuit Extra Income Flexibility 37% = Run Own Business 71% = Always Wanted To Be Own Boss 33% =Use Multiple On-Demand Platforms 46% =Want To Control Schedule Basics 26% = Employed Full-Time (W2 Wages) 19% = Responsible for Family Care 14% = Employed Part-Time (W2 Wages) 9% = Active Student 5% = Retired 57% = Earn Extra Income 91% =Control Own Schedule 21% =Make Up For Financial Hardship 50% = Do Not Want Traditional Job 19% = Earn Income While Job Searching 35% = Have Better Work / Life Balance Benefits $34 Average Hourly Income 11 Average Weekly Hours With Primary On-Demand Platform $12K Average Annual Income 37Average Weekly Hours of Work 24% Average Share of Total Income (All Types / Platforms) Source: Intuit, 2017 Note: Intuit partnered with 12 On-Demand Economy platforms which provided access to their provider email lists. (n = 6,247 respondents who had worked on-demand within the past 6 months). The survey 169 focused on online talent marketplaces. Airbnb and other online capital marketplaces were not included.

On-Demand Platform Specifics… 170

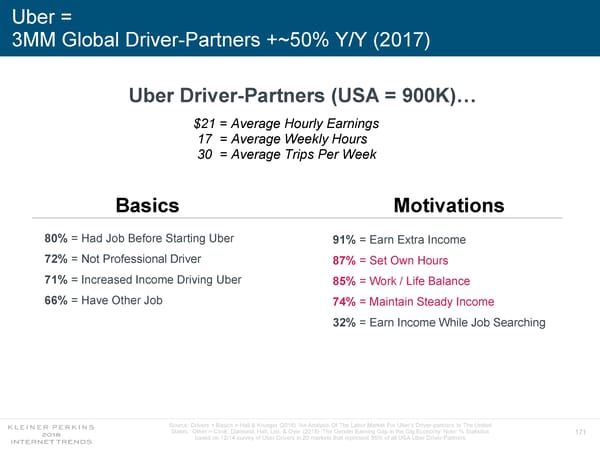

Uber = 3MM Global Driver-Partners +~50% Y/Y (2017) Uber Driver-Partners (USA = 900K)… $21 = Average Hourly Earnings 17 = Average Weekly Hours 30 = Average Trips Per Week Basics Motivations 80% =Had Job Before Starting Uber 91% =Earn Extra Income 72% =Not Professional Driver 87% =Set Own Hours 71% = Increased Income Driving Uber 85% = Work / Life Balance 66%= Have Other Job 74% =Maintain Steady Income 32% = Earn Income While Job Searching Source: Drivers + Basics = Hall & Krueger (2016) ‘An Analysis Of The Labor Market For Uber’s Driver-partners In The United States.’ Other = Cook, Diamond, Hall, List, & Oyer (2018) ‘The Gender Earning Gap in the Gig Economy’ Note: % Statistics 171 based on 12/14 survey of Uber Drivers in 20 markets that represent 85% of all USA Uber Driver-Partners